(Advocate) ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~GST & INCOME TAX ============================================================================ Sharing of Information related to GST and INCOME TAX.

Search Box

Sunday, 17 July 2022

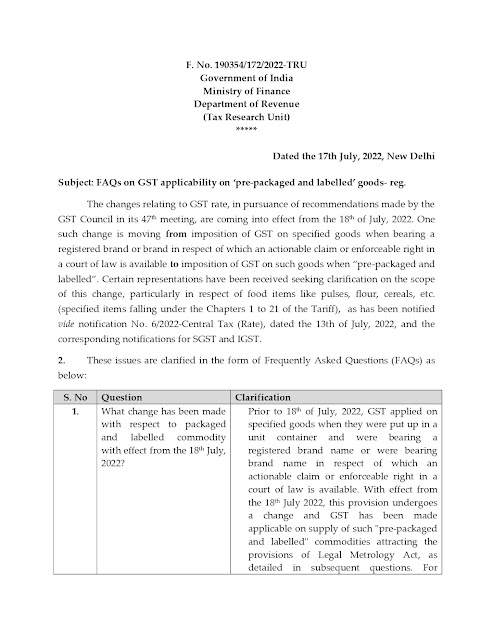

Finally CBIC has issued clarification on Prepacked and labelled issue today dated 17th July, 2022

अंतत: सीबीआईसी ने आज दिनांक 17 जुलाई, 2022 को पहले से पैक और लेबल किए गए मुद्दे पर स्पष्टीकरण जारी किया है

Finally CBIC has issued clarification on Prepacked and labelled issue today dated 17th July, 2022

FAQ 3 Thus, it is clarified that a single package of

these items [cereals, pulses, flour etc.] containing a quantity of more than 25 Kg/25 litre would not fall in the category of pre-packaged and labelled commodity for

the purposes of GST and would therefore not attract GST.

25 Kg या 25 Ltr के ज्यादा के Prepacked and Labelled में GST नहीं लगेगा

Wednesday, 29 June 2022

Key Highlights of GST Council Meetings (Press Release & Notification awaited)- 47 th Meeting of the GST Council , Chandigarh 28th and 29t hJune , 2022

👩🏼🎓 GST Council decides to refer the matter of setting up GST Appellate Tribunals (GSTAT) to GoM (group of ministers)

👩🏼🎓 GoM to deliberate and come up with a report on detailed structure for #Tribunals

👨🏻💻6 new e-invoice portals to come soon

📜Compliances to be eased for e-commerce suppliers

📜Council agrees to empower both State and Central Officers to issue Show Cause Notices

🚡GST Council agrees to reduce GST on Ropeway services from 18% to 5% with ITC. This has been done on request from Himachal Pradesh Government.

#ARR

✅GST Council further extends the time limit for filling GSTR-4 by Composition Dealers for FY 2021-22 upto 28-Jul-22 from 30-Jun-22

✅Council accepts GOM's view to withdraw 🚫 GST Exemptions on following Packaged items:

❌Curd

❌Lassi

❌Butter Milk छाछ

❌ Puffed Rice मुरमुरे

❌ Flattened Rice पोहा or चिवड़ा

❌Parched Rice

❌Pappad

❌Paneer

❌ Honey 🍯

❌Food Grains

❌Cerals

❌Jaggery

❌Few Vegetables

✅Hotel Accommodation below Rs 1,000/- per day will be taxes @ 12%

🚩GST Rate Hike

✳️5% to 18%

🔺e-Waste

🔺Milling Machinery for Cerals

✳️5% to 12%

🔺Solar Water Heater

🔺 Finished Leather

🔺 Specified goods for Petroleum Products

✳️12% to 18%

🔺LED Lamps

🔺Knives

🔺Blades

🔺Power Driven Pumps

🔺Dairy Machines

✅GST Council decides to withdraw the following exemptions:

🔷Services by Postal Department except for Post Cards or envelopes <10 gms

🔷services provided by RBI, SEBI, IRDAI, FSSAI

🔷Storage & Warehousing of Taxable Goods like Sugar, Natural Fiber, etc

🔷Services like Fumigation of Warehouses

🔷Business class Travel to the Northeastern States

🔷Road and Rail Transport, when such services are Input for Business

🔷Services by way of Slaughtering of Animals

GST Council Meet Updates Tax Rates revision approved

* Tax @ 18% on cheques, lose or in book form

* Witdrawal of exemption on services by department of posts except post cards, envelopes less than 10 gm

* Increase in GST on e-waste from 5% to 18%

* Withdrawal of exemption to services provided by RBI, Sebi, IRDAI, FSSAI

* Hotel accommodation below Rs 1,000 be taxed at 12%

* Withdrawal on GST exemption on storage and warehousing of taxable goods like sugar, natural fiber

* Withdrawal of exemption on services like fumigation of warehouses

* Withdrawal of exemption to business class air travel for northeastern states

* Withdrawal of exemptions on road and rail transport, when such services are input for business

* Withdrawal of exemption on services by way of slaughtering of animals

* Input tax credit Refund on account of inverted duty structure in edible oils, coal disallowed.

* GST Council approves to replace the term ‘branded’ with ‘pre packaged and labelled’ for retail sale to avoid disputes. (Branded cereals, food attract 5% GST currently)

* Exemption for food items, cereals sold loose or unlabeled continued.

* Tax increased LED lamps, ink, knives, blades, power driven pumps, dairy machinery from 12% to 18%

* Tax increased on milling machinery for cereals from 5% to 18%

* Tax increased on solar water heater, finished leather from 5% to 12%

* Tax increased on work contract services supplied to govt, local authorities to 18% to correct inversion

* Tax increased on specified goods for petroleum from 5% to 12% on input goods to correct inversion

How to File ITR - U(ITR for Previous Year)

How to File ITR - U(ITR for Previous Year)

FORM ITR-U (INDIAN INCOME TAX UPDATED RETURN):

During the Union Budget 2022, A new sub-section (8A) in section 139 is proposed to be introduced to provide for the furnishing of updated returns under the new provisions.

The Finance Bill 2022 has been passed in the houses of parliament and CBDT has inserted a new Rule 12AC in the Income-tax Rules, 1962 w.e.f 1st April 2022.

Persons eligible to file Form ITR-U:

Any person, whether or not he has furnished a return under-

- Section 139(1) – ITR filing until the due date

- Section 139(4) – Belated Return

- Section 139(5) – Revised Return

ITR-U allows any taxpayer-

- to file the return of income not filed earlier.

- to rectify any incorrect disclosure in ITR.

- to rectify or change the head of Income.

- to reduce carry the forward loss.

- to reduce unabsorbed depreciation.

- to reduce income tax credit etc.

Cases in which Form ITR-U can be filed:

Any of the following reasons may be selected in Form ITR-U

- Return previously not filed

- Income not reported correctly

- Wrong heads of income chose

- Reduction of carried forward losses.

- Reduction of unabsorbed depreciation

- Reduction of tax credit u/s 115JB/115JC

- Wrong rate of tax

- Others

Cases in which Form ITR-U cannot be filed:

- Nil Return.

- Return of a loss

- The claim of Refund or Increase in a refund.

- Reduction in Tax Liability.

- Search/ Survey/ Prosecution Proceedings are initiated in the case of such person or any other person.

- any proceeding for assessment or reassessment or recomputation or revision of income under this Act is pending or completed for relevant AY in his case.

Late fees and Additional Fees will also be charged.

Additional income-tax payable at the time of furnishing the return under sub-section (8A) of section 139:

· If such return is furnished after the expiry of 12 months from the end of the relevant assessment year but before completion of the period of 24 months from the end of the relevant assessment year – 50% of the aggregate of tax, interest and fees payable as per the provisions of the Act.

Now taxpayer has the following options

Before the expiry of the time limit specified under section 139(5) of the Income Tax Act, 1961.- Filing of revised return under section 139(5) of Income Tax Act, 1961 or

- Filing of updated return under section 139(8A) of Income Tax Act, 1961 or

- Rectification of return under section 154 of Income Tax Act, 1961.

- Filing of updated return under section 139(8A) of Income Tax Act, 1961 or

- Rectification of return under section 154 of Income Tax Act, 1961.

· After the expiry of 24 months from the end of the relevant assessment year up to the time limit specified under section 154 of the Income Tax Act, 1961.

- Rectification of return under section 154 of Income Tax Act, 1961.

ITR U has been enabled for AY 2020-21 and AY 2021-22 in Excel utility for ITR 1 & 4 on 27th June 2022 in Income Tax Portal. It can be accessed through the following link- Downloads | Income Tax Department. There is no separate form for ITR-U, it can be accessed through the normal ITR-1 and ITR-4 forms.

On selection of section 139(8A) under “PART A GENERAL INFORMATION” in ITR-1 or ITR-4 in excel utility, a new worksheet named – “Part A Gen_139(8A)” will be enabled through which we can fill details related to updated return in Form ITR-U.

XML can be generated from the excel utility after filling in all the relevant information (Including mandatory fields indicated in red labels). The generated XML shall be uploaded to the Income Tax E-Filing Portal (Home | Income Tax Department). After uploading, the return shall be verified and submitted in order to complete the filing successfully.

Friday, 17 June 2022

Wednesday, 15 June 2022

CBDT released Excel Offline Utility for preparing and filing ITR-5

The Central Board of Direct Taxes ("CBDT") has released Excel Offline Utility dated June 14, 2022 for the preparation and filing of ITR-5.

Please click Downloads | Income Tax Department to access and download the same. Once prepared, you can upload the JSON to the Income-tax website.

Source #Income Tax Portal

Tuesday, 14 June 2022

ITC admissible on GST paid on GTA Service despite vehicles travelling empty in return Journey: AAR

The Gujarat Authority of Advance Ruling (AAR) has ruled that the Input Tax Credit (ITC) is admissible on GST paid on goods transport agency (GTA) service supplied to it, despite refrigerated vehicles travelling empty during the return journey.

The applicant, Vadilal, is in the business of supplying ice-cream in various states in addition to the supplies in Gujarat State. For transporting the goods to places located in different states, Vadilal has been using refrigerated vehicles because the goods have to be stored and preserved at a particular temperature to avoid deterioration in quality. Various independent agencies, which are owners of refrigerated vehicles, have been providing refrigerated vehicles to Vadilal for transportation of its goods.

After delivering the goods at the destination, the refrigerated vehicle comes back. During the return journey, ordinarily, the vehicle travels empty. The plastic trays in which Vadila transported and delivered the goods at the destination, on the other hand, may be lying empty at the location.Therefore, empty plastic trays may be brought back in the refrigerated vehicle during its return journey.

The applicant has sought an advance ruling on the issue of whether the applicant can avail input tax credit for the entire amount of GST paid on the transaction of the applicant's goods in refrigerated vehicles, although the vehicles travel empty during the return journey.

The AAR observed that the GST liability for supply of service by a GTA in respect of transportation of goods by road to a registered person shall be paid by the recipient of services. The applicant is liable to GST under Reverse Charge Mechanism (RCM) for the GTA service supplied to it.

The Reverse Charge Mechanism is the process of payment of GST by the receiver instead of the supplier. The liability of tax payment is transferred to the recipient/receiver instead of the supplier.

"ITC is admissible to Vadilal on GST paid on GTA service supplied to it, despite the fact that refrigerated vehicles travelled empty during the return journey, as Vadilal had paid an agreed freight to the GTA for its service and this agreed freight was inclusive of both the onward and return journey," the AAR said.

Applicant's Name: M/s. Vadilal Enterprises Ltd.

Source from: https://www.livelaw.in/

Friday, 10 June 2022

CBDT released compliance check functionality to facilitate tax deductors/collectors to verify “Specified Person” under Income Tax

The CBDT vide Notification No. 01 of 2022 dated June 09, 2022 has modified Notification No. 01 of 2021 dated June 22, 2021 w.r.t. compliance check functionality for Section 206AB and 206CCA of the Income-Tax Act, 1961 (“the IT Act”) to facilitate tax deductors/collectors to verify as a “Specified Person” under the IT Act.

Section 206AB and 206CCA of the Income-tax Act, 1961 (effective from July 01, 2021 and amended via Finance Act, 2022), imposed higher TDS/TCS rate on the "Specified Persons" defined as under,

“For the purposes of this section "specified person" means a person who has not furnished the return of income for the assessment year relevant to the previous year immediately preceding the financial year in which tax is required to be deducted, for which the time limit for furnishing the return of income under sub-section (1) of section 139 has expired and the aggregate of tax deducted at source and tax collected at source in his case is rupees fifty thousand or more in the said previous year:

Provided that the specified person shall not include a non-resident who does not have a permanent establishment in India.

Explanation- For the purposes of this sub-section, the expression "permanent establishment" includes a fixed place of business through which the business of the enterprise is wholly or partly carried on.”

To facilitate Tax Deductors and Collectors in identification of Specified Persons as defined in sections 206AB and 206CCA, the Central Board of Direct Taxes ("CBDT"), in exercise of powers conferred under section 138(1)(a)(i) of Income-tax Act, 1961 (Act), has issued Order via F.No. 225/67/2021/ITA.II dated June 21, 2021, directing that Director General of Income-tax (Systems), New Delhi shall be the specified income-tax authority for furnishing information to the "Tax Deductor/Tax Collector", having registered in the reporting portal of the Project Insight through valid TAN, to identify the 'Specified Persons' for the purposes of section 206AB and 206CCA of the Act through the functionality "Compliance Check for Section 206AB& 206CCA".

Income Tax Department has released a functionality "Compliance Check for Section 206AB & 206CCA" to facilitate tax deductors/collectors to verify if a person is a "Specified Person" as per section 206AB & 206CCA. This functionality is made available through (https://report.insight.gov.in

of 2021 dated June 21, 2021 and CBDT Circular No. 10 of 2022 dated May 17, 2022 regarding use of functionality under section 206AB and 206CCA of the Income-tax Act, 1961.

The following procedure is laid down for sharing of information with tax deductors/collectors:

a) Registration: Tax Deductors and Collectors can register on the Reporting Portal by logging in to e-filing portal (http://www.incometax.gov.in/) using e-filing login credential of TAN and clicking on the link "Reporting Portal" which is available under "Pending Actions Tab of the e-filing Portal. After being redirected to the Reporting Portal, the tax deductor/collector needs to select Compliance Check (Tax Deductor & Collector) under Form Type. The details of the principal officer also need to be provided by clicking on "Add Principal Officer" button. The principal officer is the authorized person of the tax deductor/collector to use the Compliance Check functionality on reporting portal. After submission of registration request, email notification will be shared with the Principal Officer along with ITDREIN details and login credentials.

b) Accessing the Compliance Check functionality: Principal Officers of the entities (Tax Deductors & Collectors) which are registered with the Reporting Portal through TAN shall be able to use the functionality after login into the Reporting Portal using their credentials. After successfully logging in, link to the functionality "Compliance Check for Section 206AB & 206CCA" will appear on the home page of the Reporting Portal.

c) Using "PAN Search" mode: Under the "Compliance Check for Section 206AB & 206CCA" page, "PAN Search" tab may be selected to access the functionality in PAN Search mode. In this mode single valid PAN along with captcha can be entered at a time and output will be available with following fields,

Financial Year: Current Financial Year

PAN: As provided in the input. Name: Masked name of the Person (as per PAN).

PAN Allotment date: Date of allotment of PAN.

PAN-Aadhaar Link Status: Status of PAN-Aadhaar linking for individual PAN holders as on date. The response options are Linked (PAN and Aadhaar are linked), Not Linked (PAN & Aadhaar are not linked), Exempt (PAN is exempted from PAN-Aadhaar linking requirements as per Department of Revenue Notification No. 37/2017 dated May 11, 2017) or Not-Applicable (PAN belongs to non-individual person).

Specified Person u/s 206AB & 206CCA: The response options are Yes (PAN is a specified person as per section 206AB/206CCA as on date) or No (PAN is not a specified person as per section 206AB/206CCA as on date).

Output will also provide the date on which the "Specified Person" status as per section 206AB and 206CCA is determined.

d) Using "Bulk Search" mode: Under the "Compliance Check for Section 206AB & 206CCA" functionality page, "Bulk Search" tab may be selected to access the functionality in Bulk Search mode. This mode involves following steps:

i. Preparing request (input) file containing PANS: Under the "Bulk Search" page, CSV Template to enter PANS details may be downloaded by clicking on "Download CSV template" button. PANS for which "Specified Person" status is required may be entered in the downloaded CSV template. The current limit in the number of PANS in a single file is 10,000.

ii. Uploading the input CSV file: Input CSV file may be uploaded by clicking on Upload CSV button. Uploaded file will start reflecting with Uploaded status.

iii. Downloading the output CSV file: After processing, CSV file containing "Specified Person" status as per section 206AB & 206CCA of the entered PANS will be available for download and "Status" will change to Available. Output CSV file will contain PAN, Masked Name, Specified Person Status as per section 206AB & 206CCA, PAN-Aadhar Link status and other details as mentioned in paragraph c) above. After downloading of the file, the status will change to Downloaded. The download link will expire and status will change to Expired after specified time (presently 24 hours of availability of the file).

For any further assistance, Tax Deductors & Collectors can refer to Quick Reference Guide on Compliance Check for Section 206AB & 206CCA and Frequently Asked Questions (FAQ) available under "Resources" section of Reporting Portal. They can also navigate to the "Help" section of Reporting Portal for submitting query or to get a call back from Customer Care Team of Income-tax Department. Customer Care Team of Income-tax Department can also be reached by calling on its Toll Free number 1800 103 4215 for any assistance.

Notification No. 01 of 2021 dated June 22, 2021 is modified to the extent of what is contained in this notification

The Notification can be accessed at: https://www.incometaxindia.

Thursday, 2 June 2022

अगर आपने Eway बिल में Vehicle Type में Regular की जगह Over Dimensional Cargo (ODC) को select कर लिया है, जबकि आपके पास normal regular गाड़ी ही है तो ये गलती आपकी Minor Error में आती है और इसके लिए आप पर 1000/- की पेनल्टी लगेगी, ना की Section 129 की पेनल्टी

अगर आपने Eway बिल में Vehicle Type में Regular की जगह Over Dimensional Cargo (ODC) को select कर लिया है, जबकि आपके पास normal regular गाड़ी ही है तो ये गलती आपकी Minor Error में आती है और इसके लिए आप पर 1000/- की पेनल्टी लगेगी, ना की Section 129 की पेनल्टी

जीएसटी के 5 साल CA- सुधीर हालाखंडी की कलम से

जीएसटी को भारत में लगे इस समय 5 वर्ष होने को आये

हैं तो आइये यह एक समय है की देखें की इस अवधि में जीएसटी

उन लक्ष्यों को प्राप्त कर सका जीनकी उम्मीद सभी पक्षों ने उस

वक्त की थी जिस समय जीएसटी भारत में लागू किया गया था .

GST पोर्टल पर सक्षम एक GSTIN के तहत विभिन्न ट्रेड नाम जोड़ने का विकल्प।

Option to add Different Trade Names under one GSTIN enabled on GST portal.

Very useful for Taxpayers having Multiple Businesses on the same GSTIN with Different Trade Names

GST पोर्टल पर सक्षम एक GSTIN के तहत विभिन्न ट्रेड नाम जोड़ने का विकल्प।

विभिन्न व्यापार नामों के साथ एक ही GSTIN पर कई व्यवसाय करने वाले करदाताओं के लिए बहुत उपयोगी