(Advocate) ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~GST & INCOME TAX ============================================================================ Sharing of Information related to GST and INCOME TAX.

Search Box

Sunday, 17 July 2022

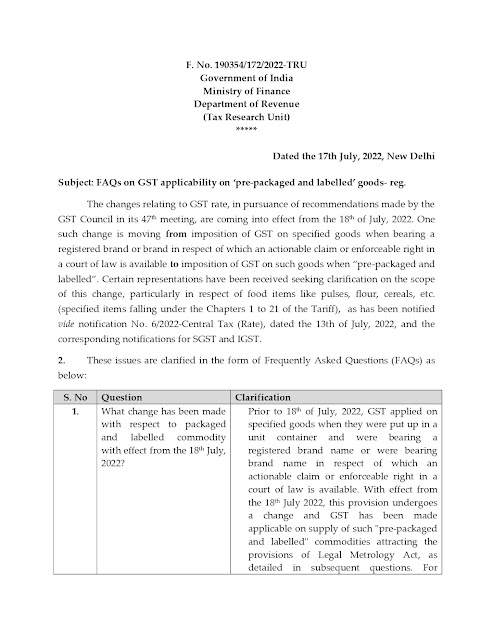

Finally CBIC has issued clarification on Prepacked and labelled issue today dated 17th July, 2022

अंतत: सीबीआईसी ने आज दिनांक 17 जुलाई, 2022 को पहले से पैक और लेबल किए गए मुद्दे पर स्पष्टीकरण जारी किया है

Finally CBIC has issued clarification on Prepacked and labelled issue today dated 17th July, 2022

FAQ 3 Thus, it is clarified that a single package of

these items [cereals, pulses, flour etc.] containing a quantity of more than 25 Kg/25 litre would not fall in the category of pre-packaged and labelled commodity for

the purposes of GST and would therefore not attract GST.

25 Kg या 25 Ltr के ज्यादा के Prepacked and Labelled में GST नहीं लगेगा

Wednesday, 15 June 2022

CBDT released Excel Offline Utility for preparing and filing ITR-5

The Central Board of Direct Taxes ("CBDT") has released Excel Offline Utility dated June 14, 2022 for the preparation and filing of ITR-5.

Please click Downloads | Income Tax Department to access and download the same. Once prepared, you can upload the JSON to the Income-tax website.

Source #Income Tax Portal

Friday, 10 June 2022

CBDT released compliance check functionality to facilitate tax deductors/collectors to verify “Specified Person” under Income Tax

The CBDT vide Notification No. 01 of 2022 dated June 09, 2022 has modified Notification No. 01 of 2021 dated June 22, 2021 w.r.t. compliance check functionality for Section 206AB and 206CCA of the Income-Tax Act, 1961 (“the IT Act”) to facilitate tax deductors/collectors to verify as a “Specified Person” under the IT Act.

Section 206AB and 206CCA of the Income-tax Act, 1961 (effective from July 01, 2021 and amended via Finance Act, 2022), imposed higher TDS/TCS rate on the "Specified Persons" defined as under,

“For the purposes of this section "specified person" means a person who has not furnished the return of income for the assessment year relevant to the previous year immediately preceding the financial year in which tax is required to be deducted, for which the time limit for furnishing the return of income under sub-section (1) of section 139 has expired and the aggregate of tax deducted at source and tax collected at source in his case is rupees fifty thousand or more in the said previous year:

Provided that the specified person shall not include a non-resident who does not have a permanent establishment in India.

Explanation- For the purposes of this sub-section, the expression "permanent establishment" includes a fixed place of business through which the business of the enterprise is wholly or partly carried on.”

To facilitate Tax Deductors and Collectors in identification of Specified Persons as defined in sections 206AB and 206CCA, the Central Board of Direct Taxes ("CBDT"), in exercise of powers conferred under section 138(1)(a)(i) of Income-tax Act, 1961 (Act), has issued Order via F.No. 225/67/2021/ITA.II dated June 21, 2021, directing that Director General of Income-tax (Systems), New Delhi shall be the specified income-tax authority for furnishing information to the "Tax Deductor/Tax Collector", having registered in the reporting portal of the Project Insight through valid TAN, to identify the 'Specified Persons' for the purposes of section 206AB and 206CCA of the Act through the functionality "Compliance Check for Section 206AB& 206CCA".

Income Tax Department has released a functionality "Compliance Check for Section 206AB & 206CCA" to facilitate tax deductors/collectors to verify if a person is a "Specified Person" as per section 206AB & 206CCA. This functionality is made available through (https://report.insight.gov.in

of 2021 dated June 21, 2021 and CBDT Circular No. 10 of 2022 dated May 17, 2022 regarding use of functionality under section 206AB and 206CCA of the Income-tax Act, 1961.

The following procedure is laid down for sharing of information with tax deductors/collectors:

a) Registration: Tax Deductors and Collectors can register on the Reporting Portal by logging in to e-filing portal (http://www.incometax.gov.in/) using e-filing login credential of TAN and clicking on the link "Reporting Portal" which is available under "Pending Actions Tab of the e-filing Portal. After being redirected to the Reporting Portal, the tax deductor/collector needs to select Compliance Check (Tax Deductor & Collector) under Form Type. The details of the principal officer also need to be provided by clicking on "Add Principal Officer" button. The principal officer is the authorized person of the tax deductor/collector to use the Compliance Check functionality on reporting portal. After submission of registration request, email notification will be shared with the Principal Officer along with ITDREIN details and login credentials.

b) Accessing the Compliance Check functionality: Principal Officers of the entities (Tax Deductors & Collectors) which are registered with the Reporting Portal through TAN shall be able to use the functionality after login into the Reporting Portal using their credentials. After successfully logging in, link to the functionality "Compliance Check for Section 206AB & 206CCA" will appear on the home page of the Reporting Portal.

c) Using "PAN Search" mode: Under the "Compliance Check for Section 206AB & 206CCA" page, "PAN Search" tab may be selected to access the functionality in PAN Search mode. In this mode single valid PAN along with captcha can be entered at a time and output will be available with following fields,

Financial Year: Current Financial Year

PAN: As provided in the input. Name: Masked name of the Person (as per PAN).

PAN Allotment date: Date of allotment of PAN.

PAN-Aadhaar Link Status: Status of PAN-Aadhaar linking for individual PAN holders as on date. The response options are Linked (PAN and Aadhaar are linked), Not Linked (PAN & Aadhaar are not linked), Exempt (PAN is exempted from PAN-Aadhaar linking requirements as per Department of Revenue Notification No. 37/2017 dated May 11, 2017) or Not-Applicable (PAN belongs to non-individual person).

Specified Person u/s 206AB & 206CCA: The response options are Yes (PAN is a specified person as per section 206AB/206CCA as on date) or No (PAN is not a specified person as per section 206AB/206CCA as on date).

Output will also provide the date on which the "Specified Person" status as per section 206AB and 206CCA is determined.

d) Using "Bulk Search" mode: Under the "Compliance Check for Section 206AB & 206CCA" functionality page, "Bulk Search" tab may be selected to access the functionality in Bulk Search mode. This mode involves following steps:

i. Preparing request (input) file containing PANS: Under the "Bulk Search" page, CSV Template to enter PANS details may be downloaded by clicking on "Download CSV template" button. PANS for which "Specified Person" status is required may be entered in the downloaded CSV template. The current limit in the number of PANS in a single file is 10,000.

ii. Uploading the input CSV file: Input CSV file may be uploaded by clicking on Upload CSV button. Uploaded file will start reflecting with Uploaded status.

iii. Downloading the output CSV file: After processing, CSV file containing "Specified Person" status as per section 206AB & 206CCA of the entered PANS will be available for download and "Status" will change to Available. Output CSV file will contain PAN, Masked Name, Specified Person Status as per section 206AB & 206CCA, PAN-Aadhar Link status and other details as mentioned in paragraph c) above. After downloading of the file, the status will change to Downloaded. The download link will expire and status will change to Expired after specified time (presently 24 hours of availability of the file).

For any further assistance, Tax Deductors & Collectors can refer to Quick Reference Guide on Compliance Check for Section 206AB & 206CCA and Frequently Asked Questions (FAQ) available under "Resources" section of Reporting Portal. They can also navigate to the "Help" section of Reporting Portal for submitting query or to get a call back from Customer Care Team of Income-tax Department. Customer Care Team of Income-tax Department can also be reached by calling on its Toll Free number 1800 103 4215 for any assistance.

Notification No. 01 of 2021 dated June 22, 2021 is modified to the extent of what is contained in this notification

The Notification can be accessed at: https://www.incometaxindia.

Thursday, 2 June 2022

अगर आपने Eway बिल में Vehicle Type में Regular की जगह Over Dimensional Cargo (ODC) को select कर लिया है, जबकि आपके पास normal regular गाड़ी ही है तो ये गलती आपकी Minor Error में आती है और इसके लिए आप पर 1000/- की पेनल्टी लगेगी, ना की Section 129 की पेनल्टी

अगर आपने Eway बिल में Vehicle Type में Regular की जगह Over Dimensional Cargo (ODC) को select कर लिया है, जबकि आपके पास normal regular गाड़ी ही है तो ये गलती आपकी Minor Error में आती है और इसके लिए आप पर 1000/- की पेनल्टी लगेगी, ना की Section 129 की पेनल्टी

जीएसटी के 5 साल CA- सुधीर हालाखंडी की कलम से

जीएसटी को भारत में लगे इस समय 5 वर्ष होने को आये

हैं तो आइये यह एक समय है की देखें की इस अवधि में जीएसटी

उन लक्ष्यों को प्राप्त कर सका जीनकी उम्मीद सभी पक्षों ने उस

वक्त की थी जिस समय जीएसटी भारत में लागू किया गया था .

Monday, 16 May 2022

Maharashtra and Uttar Pradesh top in GST registrations

Maharashtra and Uttar Pradesh have topped in Goods and Services Tax (GST) registrations by businesses and dealers followed by Gujarat and Tamil Nadu, reflecting that economic prowess of these states.

Official data from the government on aggregate GST registrations in the 2017-22 period showed that Maharashtra has 1.48 million normal GST payers who pay taxes on a monthly basis, while Uttar Pradesh has 1.33 million such tax payers. However, if smaller traders who pay taxes on a quarterly basis are included, Uttar Pradesh has 1.69 million GST registrations, while Maharashtra has 1.6 million registrations, showed official data which was previously not available. The figures do not include service distributors and casual tax payers which are smaller in number.

Gujarat has 1.09 million normal and composition tax payers, while Tamil Nadu has 1.06 million GST registrations. Businesses having operations in different states are required to take registrations in each of the states where they operate. Karnataka has over 953,000 GST registrations, while Rajasthan has over 795,000 GST registrations. Nagaland, Mizoram, Sikkim, Lakshadweep and Andaman and Nicobar Islands have fewer than 10,000 GST registrations.

GST registrations also indicate the nature of the economic activity. Uttar Pradesh has the largest share of small businesses with the state accounting for over 357,000 composition dealers those with sales upto ₹1.5 crores who have signed up for the quarterly tax payment facility. Maharashtra has over 122,000 composition dealers, while Rajasthan has over 137,000 composition dealers.

Source from: https://www.livemint.

We have recently released the 7th Edition (May, 2022) of our book on Goods and Services Tax, titled, "GST LAW AND COMMENTARY – WITH ANALYSIS AND PROCEDURES", updated with the Finance Act, 2022 in a set of 4 Volumes. We thank you all for the support and your enduring response.

Sunday, 26 December 2021

New GST rates on textile likely from January 1, 2022

Despite concerns expressed by the industry, the government is unlikely to defer implementation of higher Goods and Services Tax (GST) on certain textile products, as the decision was taken by the GST Council.

The new GST rates will kick in from January 1, 2022.

The sector had opposed the increase citing higher compliance costs, especially for the unorganised sector and micro, small and medium enterprises (MSMEs), besides making clothing more expensive for the poor.

The finance ministry is expected to take up with the GST Council the concerns raised by the industry over the latter's decision to increase the rates on several textile products to 12%.

The Council had in its previous meeting held in Lucknow on September 17, 2020 decided to correct the inverted duty structure on footwear and textiles. After this, the GST on footwear and textiles was raised to 12%, effective January 1, 2022.

"The decision to implement from January 1, 2022 was taken by the Council after intense deliberations. We will place the representations before the Council whenever it meets next," an official said.

Since the GST was raised by the Council, any decision on the rates or implementation also lay with it, the official added.

Once it kicks in, an apparel will attract 12% GST as against 5% on sale value of up to Rs 1,000 per piece currently. Similarly, the 5% tax on sale value of up to Rs 1,000 per pair of footwear has been increased to 12%.

GST on woven fabric, sewing thread of man-made filaments, synthetic filament yarn other than sewing thread, synthetic monofilament, and artificial filament yarn including artificial monofilament, among others, have also been increased to 12% from 5% earlier. "Inverted duty structure broadly harms the sector as companies are unable to take credit of higher tax paid on inputs. It had to be corrected to help the industry," the official said.

The government has said that uniform GST will aid in the resolution of input tax credit residues that got accumulated due to the inverted tax structure earlier.

It will enable the industry to encash piled-up input tax credit progressively, the textiles ministry said last month.

The Confederation of All India Traders said that any hike in GST rates on textiles will adversely affect consumers and block capital for small traders.

Sources said the textiles ministry had not taken up the issue with the finance ministry or the GST Council Secretariat yet.

"Industry has made a representation to the finance ministry and taken up the issues with them," said another official.

Monday, 29 November 2021

होजरी निर्माताओं ने परिधानों पर संशोधित जीएसटी दर की आलोचना की -Hosiery makers slam revised GST rate on apparel

साउथ इंडिया होजरी मैन्युफैक्चरर्स एसोसिएशन (सिहमा) ने केंद्र से परिधान वस्तुओं पर संशोधित जीएसटी दर को वापस लेने का आग्रह किया।

जीएसटी परिषद ने अपनी पिछली बैठक में जनवरी से कई कपड़ा और परिधान वस्तुओं और जूते पर 5% से 12% तक कर बढ़ाया।

किसी भी मूल्य के बुने हुए कपड़ों पर जीएसटी दर को 1,000 रुपये तक के उत्पादों पर 5% से बढ़ाकर 12% कर दिया गया है। उद्योग के विशेषज्ञों ने कहा कि यह कार्यशील पूंजी की आवश्यकता को प्रभावित करेगा, इसके अलावा बिक्री जो कोविड संकट के बाद धीरे-धीरे बढ़ रही थी।

सिहमा के अध्यक्ष ए सी ईश्वरन ने कहा कि नया कर होजरी निर्माताओं को प्रभावित करेगा। “निम्न आय वर्ग को लाभ पहुंचाने के लिए 1,000 रुपये से कम के उत्पादों पर जीएसटी रियायत बहाल की जानी चाहिए। 500 रुपये से कम के उत्पादों पर रियायत दी जा सकती है। होजरी की एक जोड़ी की कीमत 500 रुपये हो सकती है और जीएसटी दरों में वृद्धि से लागत में और वृद्धि होगी।' "हमें उम्मीद है कि सरकार ऐसे कठिन समय में मजदूर वर्ग को और तनाव में नहीं डालेगी।"

Sunday, 25 July 2021

Talks of two GST Experts CA Sudhir Halakhandi and CA. (Adv.) Bimal Jain

Monday, 30 November 2020

माह दिसम्बर2020 की निर्धारित अंतिम तिथि

Thursday, 17 September 2020

GSTN Advisory: Delinking of Credit Note/Debit Note from invoice, while reporting them in Form GSTR-1/GSTR-6 or filing Refund

GSTN has issued an advisory dated September 17, 2020, on Delinking of Credit Note/Debit Note from an invoice, while reporting them in Form GSTR-1 / GSTR-6 or filing Refund. Till now, the original invoice number was mandatorily required to be quoted by the taxpayers, while reporting a Credit Note or Debit Note in Form GSTR-1 or Form GSTR-6.

The taxpayers have now been provided with a facility on the GST Portal to:

- A report in their Form GSTR-1 or in Form GSTR-6, single credit note or debit note issued in respect of multiple invoices

- Choose the note supply type as Regular, SEZ, DE, Export, etc., to identify the table to which such credit note or debit note pertains

- Indicate Place of Supply (POS) against each credit note or debit note, to identify the supply type i.e. Intra-State or Inter-State

- Debit /Credit Notes can be declared with tax amount, but without any taxable value also i.e. if a credit note or debit note is issued for the difference in tax rate only, then note value can be reported as ‘Zero’. The only tax amount will have to be entered in such cases.

- Similar changes have been made while reporting amendments to credit note or debit note

Corresponding changes have also been made in the refund module. Thus, while applying for a refund, taxpayers can now report such credit notes or debit notes in statements (filed during filing the refund application) without mentioning the related invoice number. The taxpayer would be required to select the document type from a drop-down comprising of invoice/ debit note/ credit note.

The change has been provided while filing refund application of following types/ cases:

- Refund for export of services with payment of tax

- Refund on account of goods & services without payment of tax

- Refund on account of supply of goods or services to SEZ with payment of tax

- Refund on account of supply of goods or services to SEZ without payment of tax

- Refund on account of Inverted duty structure

Wednesday, 9 September 2020

MCA: AGM due date for the FY ended 31.03.2020 has been extended till 31.12.2020 for all Companies

Background:-

In terms of Sub-section (1) of Section 96 of the Companies Act, 2013 (the Act) provides inter-alia, that every company, other than a One Person Company, shall in each year hold in addition to any other meetings, a general meeting as its annual general meeting (AGM) and shall specify the meeting as such in the notices calling it, and not more than fifteen months shall elapse between the date of one AGM of a company and that of the next and WHEREAS, the first proviso to sub-section (1) of Section 96 of the Act provides that in case of the first AGM, it shall be held within a period of nine months from the date of closing of the first financial year of the company and in any other case, within a period of six months, from the date of closing of the financial year.

WHEREAS, the third proviso to Section 96(1) of the Act provides that the Registrar may, for any special reason, extend the time within which any annual general meeting, other than the first annual general meeting, shall be held, by a period not exceeding three months. WHEREAS, various representations have been received from the companies, Industry bodies and Professional Institutes pointing out that several companies are finding it difficult to hold their AGM for the financial year ended on 31.03.2020 due to the difficulties faced in view of the Covid-19 Pandemic.

Order/Extension:-

MCA vide Order No. ROC/P/Sec 96/2020/414 dated September 08, 2020, have been considered and the undersigned is of the considered opinion that due to such unprecedented special reasons, the time within which the AGM for the financial year ended on 31.03.2020 is required to be held as per provisions of sub-section (1) of Section 96 ought to be extended in terms of the third proviso to Section 96(1).

Therefore, in terms of the power vested with the undersigned under the third proviso to sub-Section (1) of Section 96 of the Act, extends the time to hold the AGM, other than the first AGM, for the financial year ended on 31.03.2020 for companies within the jurisdiction of this office, which are unable to hold their AGM for such period within the due date of holding the AGM by a period of three months from the due date by which the AGM ought to have been held in accordance with the provisions of sub-section (1) of Section 96 of the Act, without requiring the companies to file applications for seeking such extension by filing the prescribed Form GNL-1.

Explanation: It is hereby clarified that the extension granted under this Order shall also cover all the pending applications filed in Form No. GNL-1 for the extension of AGM for the financial year ended on 31.03.2020, which are yet to be approved. Where the approval for the extension of AGM up to 3 months from the due date of the AGM shall be deemed to have been granted by the undersigned without any further action on the part of the company

Wednesday, 2 September 2020

GSTN: New functionalities made available for TCS and Composition taxpayers

1. Provision to make amendment, multiple times, in Table 4 of Form GSTR-8

- Earlier, if no action was taken on TCS details, auto-populated in TDS/TCS credit form, by the supplier or if the same were rejected by them in the said form, the TCS (e-commerce operators) could amend the details only once.

- Based on requests received from stakeholders, the restriction of amending the transaction details only once, in the table 4 (i.e. amendment table) of Form GSTR-8, has now been removed.

- Thus, details of table 4 (i.e. amendment table) of Form GSTR-8, can now be amended multiple times, by e-commerce operators liable to collect tax at source under section 52, while filing their Form GSTR-8.

2. TCS facility extended to composition taxpayers

- The taxpayers under composition scheme, who are permitted to make supplies through E-Commerce Operators, e.g. Restaurant Services, will now be able to view and take necessary actions in their TDS/TCS credit received form.

- E-commerce operators would now be able to add GSTIN of such composition suppliers, in their Form GSTR-8 and file the Form.

- The amount of tax collected at source, reported by E-Commerce Operators in their Form GSTR-8, will now be populated to ‘TDS /TCS credit received’ form of respective composition taxpayers.

- The amount so reported by e-commerce operators will now be available to respective composition taxpayers, for accepting or rejecting the same, in their ‘TDS and TCS credit received’ form.

- For accepted transactions, the amount would be credited to cash ledger of composition taxpayers, after successful filing of ‘TDS/ TCS Credit received’ form.

- For rejected transactions, the amount would be shown to e-commerce operators for correction.

Sunday, 30 August 2020

CBIC notified Proviso to Section 50(1) – Interest in GST to be levied on Net Tax liability w.e.f September 1, 2020

CBIC issued Press Release on availability of new functionality of Form GSTR-2B for the month of July 2020

I-T department to intimate taxpayers under scrutiny about faceless assessment

The income tax (I-T) department will soon start sending out intimation to assessees undergoing scrutiny that such cases would now be handled under faceless assessment, a tax official said on Friday.

CBDT additional commissioner Jaishree Sharma also said that domestic transfer pricing cases too will be covered under the faceless assessment mechanism.

Asked whether the previous notices still stand valid, Sharma said, "Previous notices will not become redundant. First, an intimation would be sent out that your case would now be assessed under faceless assessment scheme and if the assessing officer of the Assessment Unit feels that he needs some more information, he will send fresh (notice) under 142(1)."

A Section 142(1) notice is sent to an assessee to inquire about details and documents before making assessment under the Income Tax Act. Speaking at a webinar organised by industry body PHDCCI, Sharma said reassessment cases would also be part of the faceless scheme. "So all the 148 cases that were going on, they have been transferred to the faceless assessment scheme and NeAC will be sending out intimation in all such cases which would now be assessed under the faceless assessment scheme. So by September 15 or before that, you can expect an intimation from NeAC," Sharma said.

The Central Board of Direct Taxes (CBDT) had earlier this month notified the National e-Assessment Centre (NeAC) at Delhi for all communication with taxpayers under the faceless assessment scheme. Since August 13, all income tax returns picked up for scrutiny, except those relating to search and seizure and international tax, are being assessed under faceless assessment.

Under faceless scrutiny assessment, a central computer picks up tax returns for scrutiny based on risk parameters and mismatch and then allots them randomly to a team of officers. This allocation is reviewed by officers at another randomly selected location and only if concurred, a notice is sent by the centralized computer system. All such notices need to be responded to electronically without the requirement of visiting a tax office or meeting any official.

GSTN has enabled Form GSTR 2B in the GST Portal.

The Taxpayer can log in with there login credentials then go to F.Y 20-21 for July 2020, the Form GSTR-2B is available on the Portal.

Source: GST Portal

Tuesday, 7 July 2020

CBIC received representation on extension of due date for Form GSTR-4 for F.Y 2019-20

As per the recent tweet of CBIC, the representations have been received on non-availability and extension of date of FORM GSTR-4 for F.Y 2019-20 on the common portal. The matter of extension of date of GSTR-4 for F.Y 2019-2020 is under consideration by the GST Implementation Committee.