(Advocate) ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~GST & INCOME TAX ============================================================================ Sharing of Information related to GST and INCOME TAX.

Search Box

Saturday, 24 February 2024

MSME 43B(h) AN INTERVIEW WITH SUDHIR HALAKHANDI BY SKH TAX TEAM

SKH TAX TEAM WITH SUDHIR HALAKHANDI

MSME 43B(H) पर SKH टैक्स टीम द्वारा सुधीर हलाखंडी के साथ एक साक्षात्कार

MSME 43B(h) AN INTERVIEW WITH SUDHIR HALAKHANDI BY SKH TAX TEAM

-CA Sudhir Halakhandi

Respected CA Sudhir Halakhandi sir previous articles related to this issue

Click here to read this interview of Sudhir Halakhandi in Hindi.

GSTR-2A can now be downloaded in excel/CSV format for your reference and further use.

*GST PORTAL UPDATE:*

Facility for opting Composition Scheme for FY 2024-25 now live on GST Portal

*GST PORTAL UPDATE:*

Facility for opting Composition Scheme for FY 2024-25 now live on GST Portal

The Goods and service Tax Portal has announced that Taxpayers can opt for Composition Scheme for the Financial Year 2024-25 by accessing the GST Portal, which will be open upto March 31, 2024. *Use Navigation ‘Services -> Registration -> Application to Opt for Composition Levy’, and file Form CMP-02 to opt for the same.*

Friday, 23 February 2024

Thursday, 22 February 2024

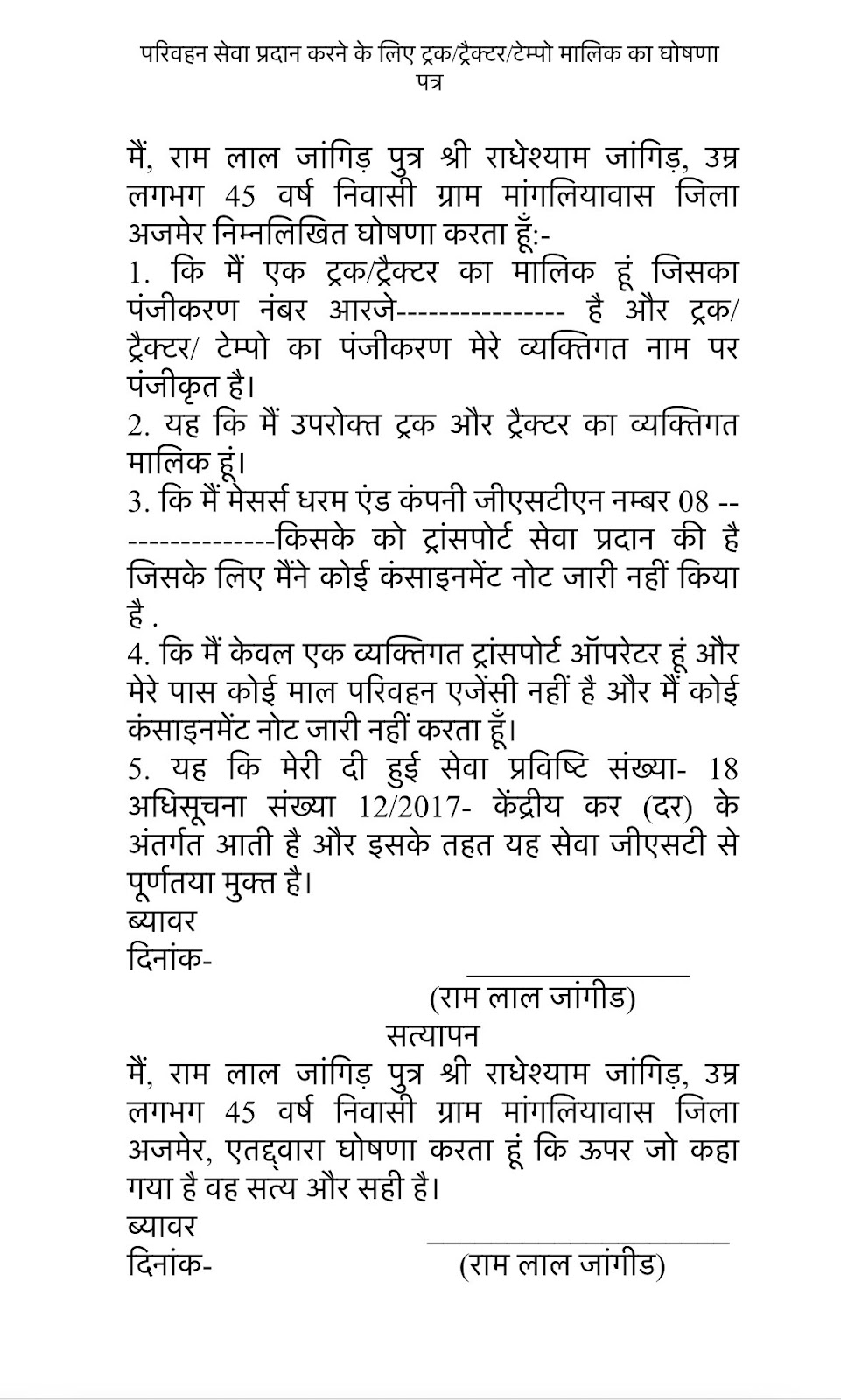

Format of Declaration to be taken from Individual Truck/Tractor/Tempo Owners that they are not GTA(non issuance of consignment note) hence Services provided are covered under Exemption

Format of Declaration to be taken from Individual Truck/Tractor/Tempo Owners that they are not GTA(non issuance of consignment note) hence Services provided are covered under Exemption

✔️Very useful at the time of audits/assessments!!

Regard

CA Abhash Halakhandi

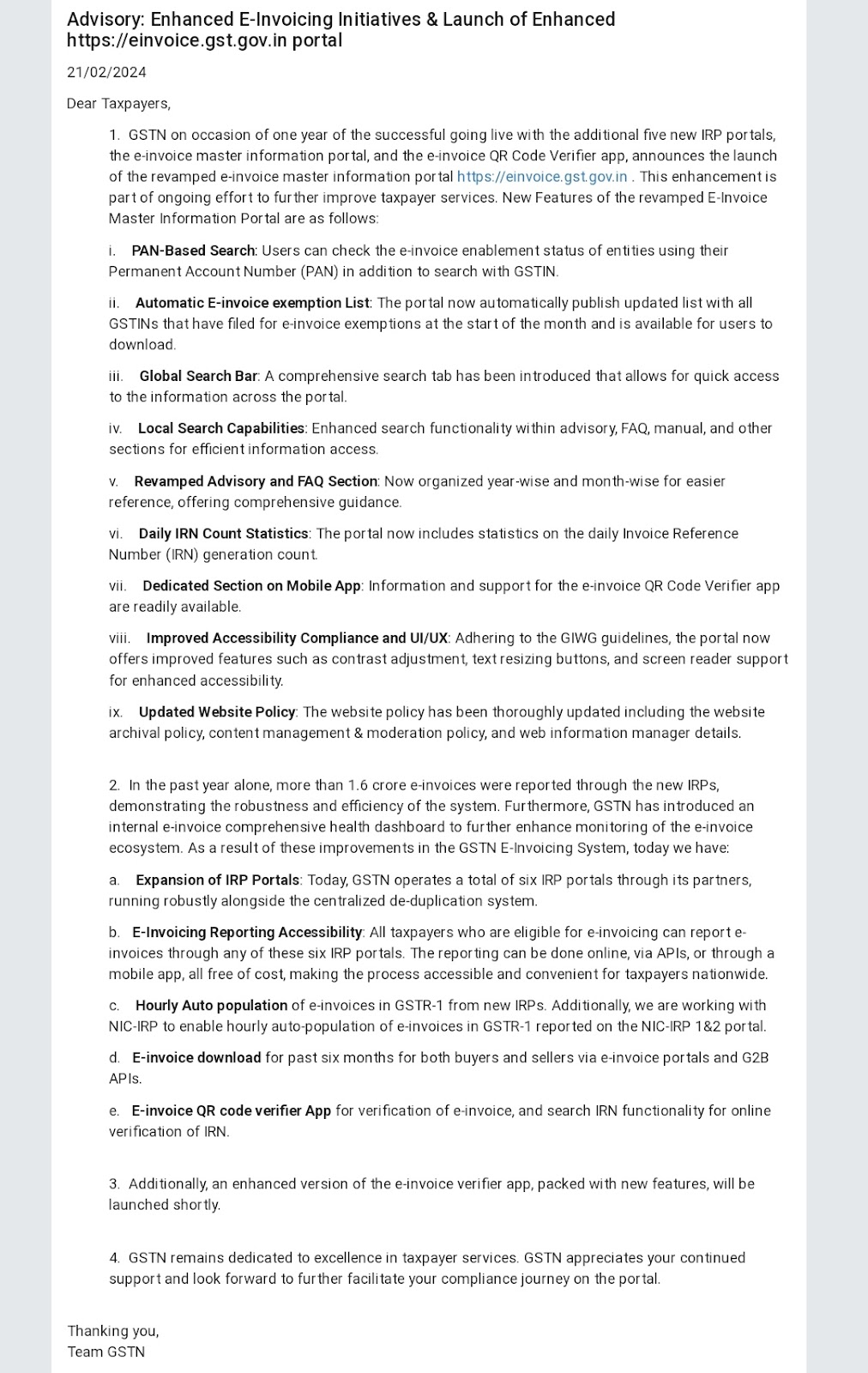

Advisory: Enhanced E-Invoicing Initiatives & Launch of Enhanced https://einvoice.gst.gov.in portal

GSTN has launch the revamped e-invoice master information portal This enhancement is part of ongoing effort to further improve taxpayer services.

https://www.gst.gov.in/newsandupdates/read/624

Monday, 19 February 2024

आम करदाता एवं व्यापारी के लिए – सरल हिंदी में MSME 43B(h) से जुड़े 10 अहम सवाल-जवाब CA सुधीर हालाखंडी

For common taxpayer and businessman – in simple Hindi

10 important questions and answers related to MSME 43B(h)

- CA Sudhir Halakhandi

आम करदाता एवं व्यापारी के लिए – सरल हिंदी में

MSME 43B(h) से जुड़े 10 अहम सवाल-जवाब

CA सुधीर हालाखंडी

Respected CA Sudhir Halakhandi sir previous articles related to this issue

Sunday, 18 February 2024

*The Art and Science of Drafting Appeal in GST a write up ✍️ by Abhishek Raja Ram*

*The Art and Science of Drafting Appeal in GST a write up ✍️ by Abhishek Raja Ram*

Schools taught us English Language through Essay writing. Grammar is crucial in writing, but the style of sharing thoughts is individual choice.

*No style is better or worse; it is just unique to you.*

I would *appeal you all to join me on LinkedIn* at:

https://www.linkedin.com/in/abhishekrajaram/

With this in mind, let's start drafting:

*1. Introduction:*

An appeal under Section 107 is allowed to any person aggrieved by the order, decision, or judgment.

Therefore, the introduction of the appeal should provide details about such order and also explain that why the person is aggrieved with such order.

*2. Right to Appeal:*

There is no inherent right to appeal. But the right to appeal flows from the provisions of the law.

Unless the law provides the right to appeal, the appeal cannot be filed.

Understanding S.107 and the relevant Rule is a must.

*3. Adherence to Timelines:*

File First *Appeal U/s 107 within 3 months + 1 month condonation.* Always follow the timelines.

First Appellate Authority can't condone delay as Limitations Act benefits don't apply in GST Laws.

_Appealing late doesn't benefit litigants._

.

*4. Where to File Appeal and the Form?*

Before appealing, determine where to file and which form to use by studying the order you're appealing against.

Form GST APL-01 is the prescribed form for first appeal.

*5. Pre-Deposit:*

10% disputed tax before appeal. Full accepted tax deposit required. No deposit for interest and penalty except U/s 129 (25%).

*6. Drafting Statement of Facts and Grounds of Appeal:*

The grounds should be meticulously crafted, focusing on presenting a clear narrative supported by evidence rather than engaging in argumentative discourse.

*7. Signature on the Appeal:*

Appeal must be signed by authorized person, not Counsel.

For Corporates, enclose Board Resolution authorizing person to file appeal.

*8. Respondent:*

Practically it is your duty to submit copy of appeal to the Respondent in First Appeal. Respondent is usually the Ward Officer (i.e. Proper Officer) who has passed the Original Order against whom you have filed the Appeal.

*9. Application of Stay: Not needed*

In GST Laws, once the appeal is accepted, there is a concept of automatic stay and therefore, there is no need to file a separate application for stay.

*10. Paper Book:*

The Paper Book is most important document. It should be exhaustive to cover the issue in dispute but concise to retain the interest. Proper Index and page numbering is always recommended. A brief description of evidence filed is also recommended.

*11. Drafting: An Art or Science?*

Crafting responses to Show Cause Notices and Appeals is an intricate dance between artistic flair and scientific precision.

The art lies in the ability to weave a compelling narrative that resonates with readers, conveying complex legal arguments in a clear and persuasive manner.

Science involves analyzing laws, regulations, precedents, and facts to craft a strong legal argument. Drafting demands creativity and analytical rigor for compelling advocacy.

I hope you will find this article useful.

Best Regards,

Abhishek Raja Ram

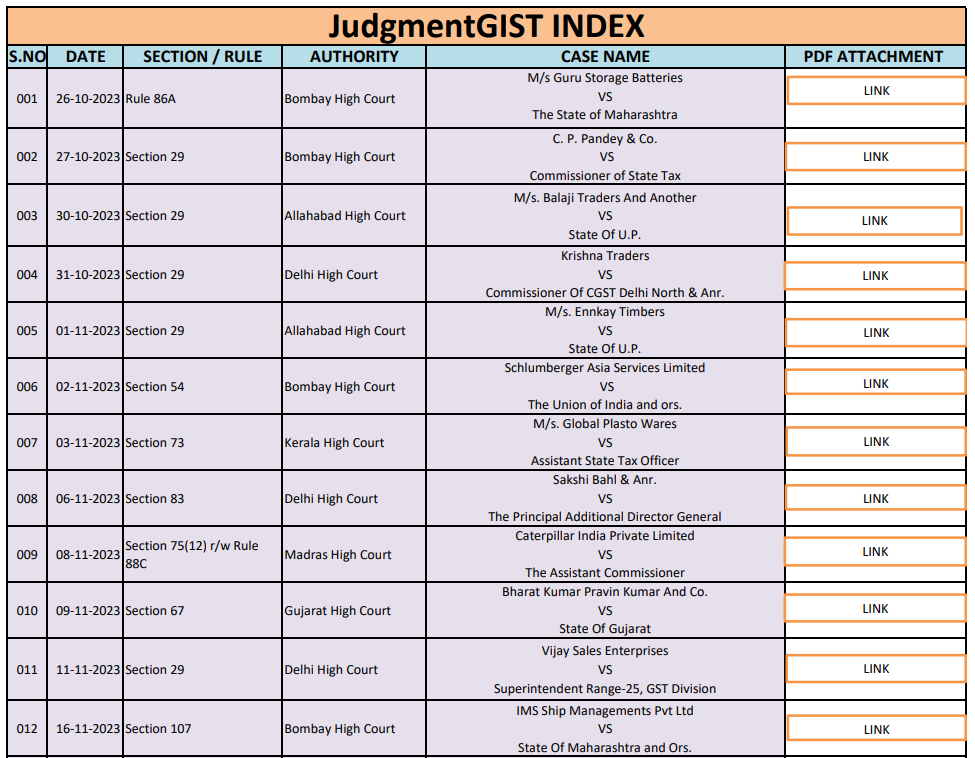

Friday, 16 February 2024

Sunday, 4 February 2024

*MSME PORTAL UPDATE*: New functionality to "Verify Udyam Registration Number" now made operational.

*MSME PORTAL UPDATE*:

New functionality to "Verify Udyam Registration Number" now made operational.

Now you can verify MSME number of your suppliers to check Section 43B(h) applicability.

The link to access is:

https://udyamregistration.gov.in/Udyam_Verify.aspx

Saturday, 3 February 2024

Subscribe to:

Comments (Atom)