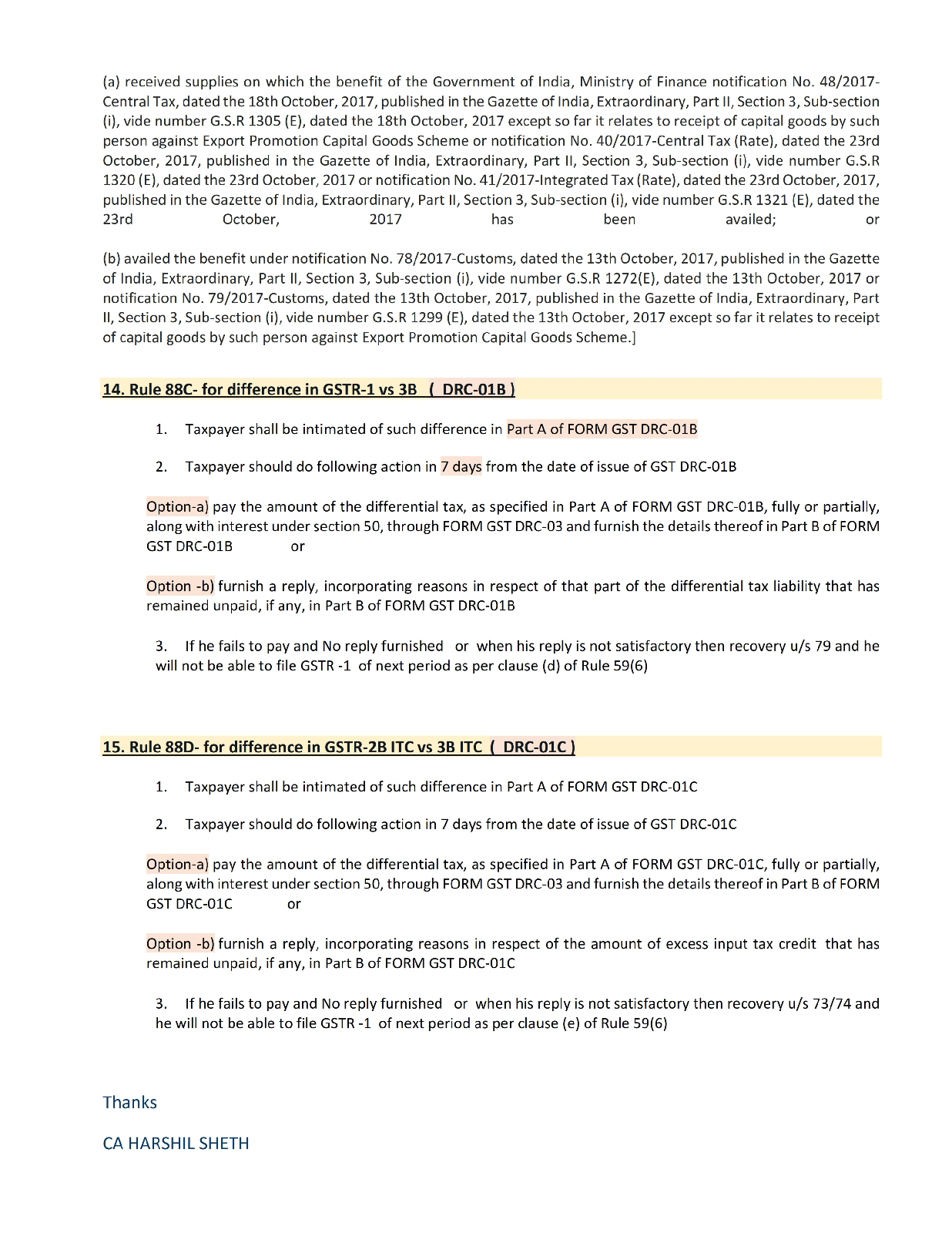

1. In order to facilitate the taxpayers in correct and accurate reporting of ITC reversal and reclaim thereof and to avoid clerical mistakes, a new ledger namely Electronic Credit and Re-claimed Statement was introduced on the GST portal. This statement was made available to help the taxpayers in tracking their ITC that has been reversed in Table 4B(2) and thereafter re-claimed in Table 4D(1) and 4A(5). Kindly click here for the detailed advisory provided earlier.

2. Now to facilitate taxpayers further, opportunity to declare opening balance for ITC reversal in the statement has been extended till 31st January, 2024.

3. Kindly note that after declaring the opening balance for ITC reversal, only three amendment opportunities post the declaration will be provided to correct declared opening balance in case of any mistakes or inaccuracies in reporting.

4. Facility to amend declared opening balance for ITC reversal will be available till 29th February, 2024.