(Advocate) ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~GST & INCOME TAX ============================================================================ Sharing of Information related to GST and INCOME TAX.

Search Box

Saturday, 15 April 2023

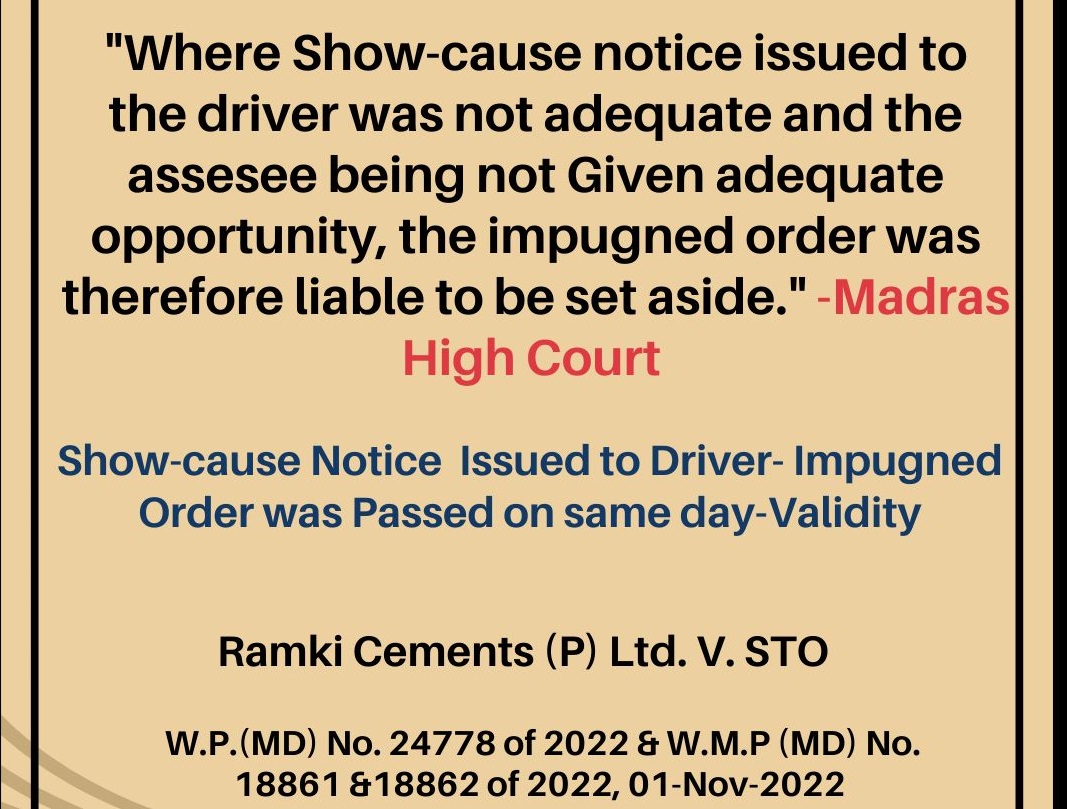

"Where Show-cause notice issued to the driver was not adequate and the assesee being not Given adequate opportunity, the impugned order was therefore liable to be set aside." -Madras High Court Show-cause Notice Issued to Driver- Impugned Order was Passed on same day-Validity Ramki Cements (P) Ltd. V. STO W.P.(MD) No. 24778 of 2022 Er W.M.P (MD) No. 18861 Er18862 of 2022, 01-Nov-2022

A writ petition has been filed to quash an order demanding tax and penalty on the petitioner's consignment, and to direct the release of the goods. The court found that the petitioner was not given adequate opportunity, the impugned order was set aside, and the respondent was directed to issue a fresh notice and pass a speaking order within eight weeks.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment