(Advocate) ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~GST & INCOME TAX ============================================================================ Sharing of Information related to GST and INCOME TAX.

Search Box

Friday, 28 April 2023

Wednesday, 26 April 2023

ICAI released the GST Act(s) and Rule(s) Bare Law updated upto the Finance Act, 2023

The Institute of Chartered Accountants of India (“ICAI”) has released the “GST Act(s) and Rule(s) – Bare Law” with the amendments made till March 31, 2023 including the amendments made vide the Finance Act, 2023. The publication consists of the Central Goods & Services Tax Act, 2017, the Integrated Goods & Services Tax Act, 2017, the Union Territory Goods & Services Tax Act, 2017, the GST (Compensation to States) Act, 2017, the Constitution (101st Amendment) Act, 2016, the Central Goods & Services Tax Rules, 2017 and the Integrated Goods & Services Tax Rules, 2017.

Wednesday, 19 April 2023

CIRCULER- updated up to 31-03-2023 index

"Adjudication order passed without providing opportunity of personal hearing to assessee was not sustainable and authority was to be directed to pass fresh order after affording opportunity of personal hearing to assessee" - High Court of Allahabad Paras Industrial sales V. State of U.P. Writ Tax No. 1518 of 2022, 15-Dec-2022

Tuesday, 18 April 2023

Construction/ Renovation of office, showroom or other Business place going on ?

Monday, 17 April 2023

"Where after passing order of detention under section 129 of cgst act against assessee, proper officer proceeded to issue order of confiscation of goods and conveyance in tran sit, thereby nullifying statutory right of owner of goods or non owners to get the goods released on compliance of con- ditions mentioned under section 129, the entire confisca- tion proceedings was rendered illegal." Karnataka High Court Notice of Confiscation issued after passing order of detention Under section-129

Sunday, 16 April 2023

APPEAL UNDER GST- APPEAL TO APPELATE AUTHORITY-BY SUDHIR HALAKHANDI

INTRODUCTION In the GST regime, the government has provided a robust mechanism for redressal of grievances of taxpayers through the appeal process. Under the GST law, any taxpayer who disagrees with the decision or order passed by an adjudicating authority can file an appeal to the Appellate Authority. This article provides an overview of the appeal process under the GST law, including the relevant provisions, rules, and forms.

WHO CAN FILE AN APPEAL? Any taxpayer or an unregistered person aggrieved by any decision or order passed against him by an adjudicating authority can file an appeal to the Appellate Authority. The appeal should be filed within three months from the date on which the said decision or order is communicated to such person.

APPELLATE AUTHORITY The Appellate Authority is an authority appointed by the government for hearing appeals filed against the decision or order passed by the adjudicating authority. The Appellate Authority has the power to examine the legality and validity of the decision or order passed by the adjudicating authority and pass an appropriate order on the appeal filed by the taxpayer.

PROCEDURE FOR FILING AN APPEAL The procedure for filing an appeal is as follows:

The taxpayer or an unregistered person should file an appeal in Form APL-01, along with a certified copy of the order against which the appeal is being filed.

The appeal should be filed within three months from the date on which the said decision or order is communicated to such person.

The taxpayer or an unregistered person should submit the appeal along with the necessary documents and fees to the Appellate Authority.

After the appeal is filed, the Appellate Authority will issue a notice to the taxpayer or an unregistered person against whom the appeal has been filed, informing him of the date and time of the hearing.

The taxpayer or an unregistered person should appear before the Appellate Authority on the date and time mentioned in the notice and present his case.

The Appellate Authority will examine the appeal and may call for additional information or documents from the taxpayer or an unregistered person.

After considering all the facts and documents presented, the Appellate Authority will pass an appropriate order, either upholding or setting aside the order passed by the adjudicating authority.

FORMS USED FOR APPEAL The following forms are used for the appeal process:

APL-01: This form is used for filing the appeal.

APL-02: This form is used for filing the reply to the appeal.

APL-03: This form is used for filing a cross-objection.

APL-04: This form is used for filing an application for rectification of an order passed by the Appellate Authority.

CONCLUSION The appeal process under the GST law provides an effective mechanism for redressal of grievances of taxpayers. The taxpayer or an unregistered person aggrieved by any decision or order passed against him by an adjudicating authority can file an appeal to the Appellate Authority, and the Appellate Authority has the power to examine the legality and validity of the decision or order passed by the adjudicating authority and pass an appropriate order on the appeal filed by the taxpayer. The taxpayer or an unregistered person should follow the prescribed procedure for filing an

Saturday, 15 April 2023

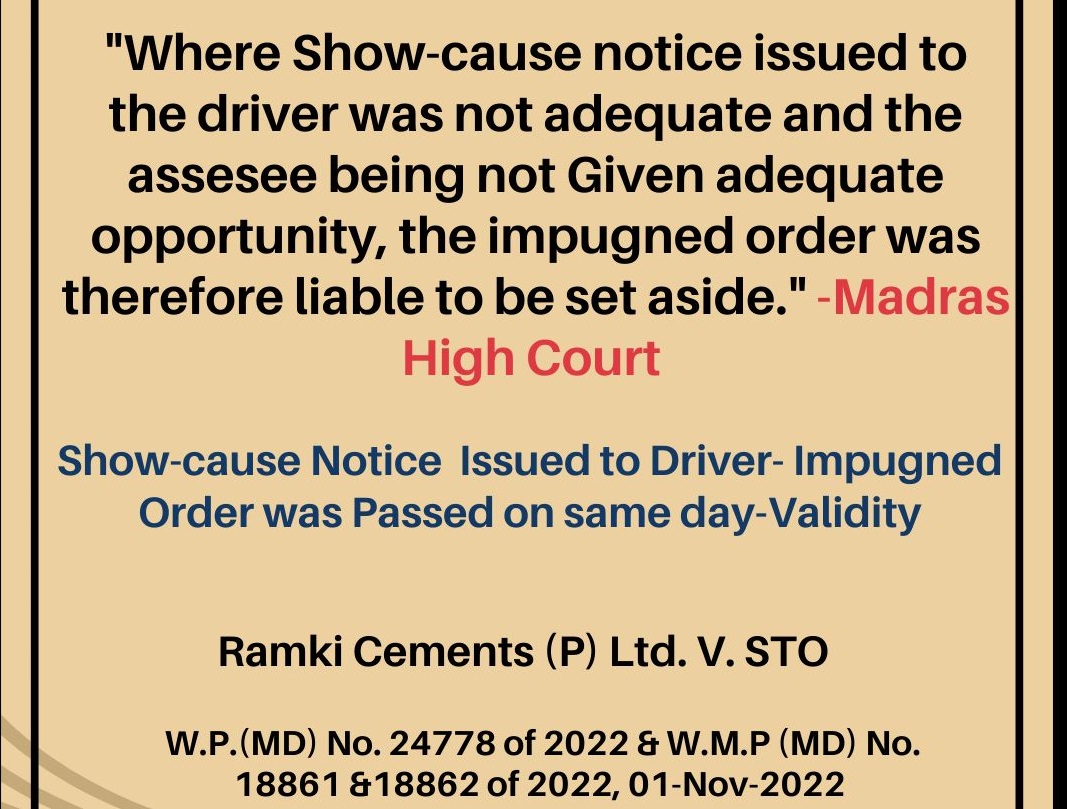

"Where Show-cause notice issued to the driver was not adequate and the assesee being not Given adequate opportunity, the impugned order was therefore liable to be set aside." -Madras High Court Show-cause Notice Issued to Driver- Impugned Order was Passed on same day-Validity Ramki Cements (P) Ltd. V. STO W.P.(MD) No. 24778 of 2022 Er W.M.P (MD) No. 18861 Er18862 of 2022, 01-Nov-2022

"Withdrawal of writ petition allowed to avail efficacious remedy of appeal as available under section 107 of OGST/CGST Act, 2017 against adjudication order raising demand for delayed payment of tax." - High Court of Orissa Nath Enterprises V. Union of India W.P.(C) Nos. 7910 and 8037 of 2022, 22-Jul-2022

The High Court of Orissa heard two writ petitions against the demand raised by the State Tax Officer, CT & GST Circle, Dhenkanal, for delayed payment of CGST & OGST for financial years 2017-18 and 2018-19. The court allowed the petitioner to leave the issue of vires of sub-sections (1) and (2) of Section 50 of the OGST/CGST Act open to be agitated in appropriate cases and allowed the withdrawal of the writ petition to avail the efficacious remedy of appeal.