(Advocate) ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~GST & INCOME TAX ============================================================================ Sharing of Information related to GST and INCOME TAX.

Search Box

Friday, 29 December 2023

Advisory: Date extension for reporting opening balance for ITC reversal

Thursday, 28 December 2023

FY 1819 Order date extended by CBIC From March 24 to April 24

Monday, 25 December 2023

Summary of GSTR-9 & GSTR-9C Optional and Mandatory Tables, since FY 2017-2018

Friday, 22 December 2023

Assessment & Audit under GST Pan India Webinar 19-12-2023

मूल्यांकन एवं लेखापरीक्षा

जीएसटी पैन इंडिया वेबिनार के तहत 19-12-2023

Assessment & Audit under GST Pan India Webinar 19-12-2023

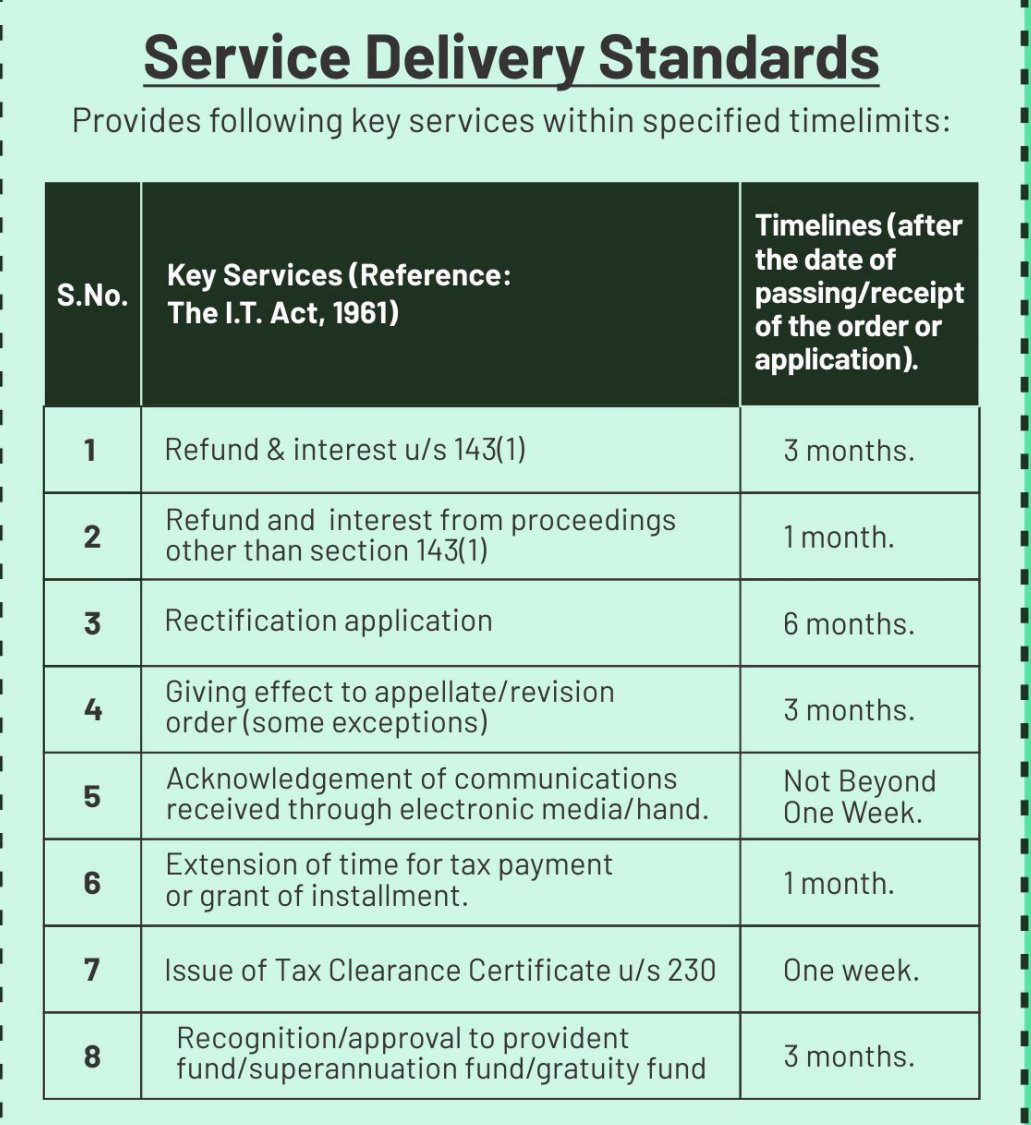

The Income Tax Department provides the following key services within specified timelines given below.

लायबिलिटी E Invoice बनाने की

Thursday, 14 December 2023

If FY 21-22 Transactions showed in FY 22-23 GSTR 3B then what to be reported in GSTR 9 of FY 22-23(Pic 1) Sale, Purchase and RCM Transactions of FY 2022-23, where it is to be Reported in GSTR 9 (Pic 2)

Wednesday, 13 December 2023

Thursday, 7 December 2023

15 Very Important GST facets that demand your attention -

Friday, 1 December 2023

*TWO FACTOR AUTHENTICATION FOR LOGIN TO GST PORTAL*

Wednesday, 29 November 2023

Advisory for the procedures and provisions related to the amnesty for taxpayers who missed the appeal filing deadline for the orders passed on or before March 31, 2023

Monday, 27 November 2023

Tuesday, 14 November 2023

Advisory for Online Compliance Pertaining to ITC mismatch -GST DRC-01C

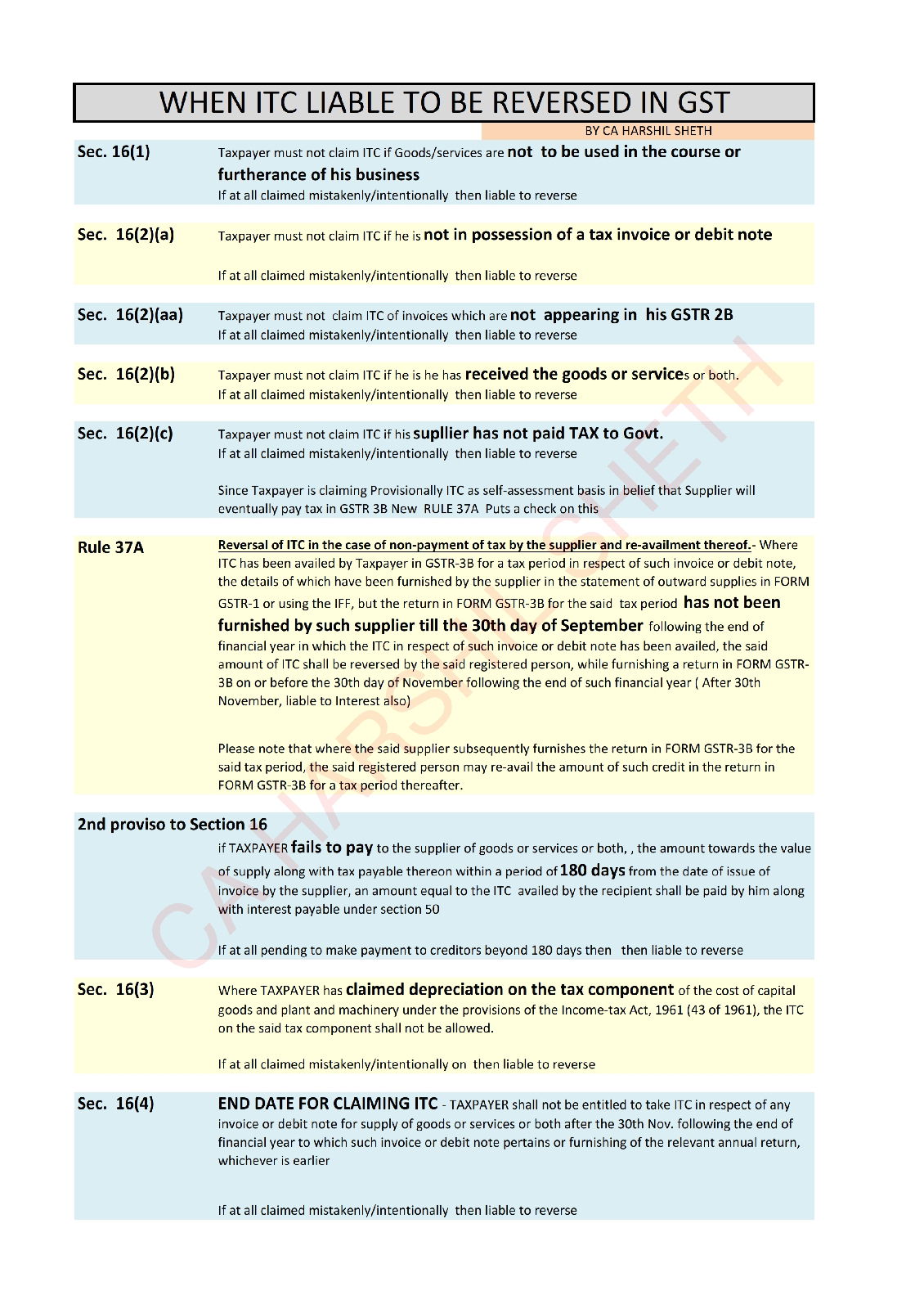

ITC Reversal on Account of Rule 37(A)

Saturday, 11 November 2023

Tuesday, 7 November 2023

*WHEN ITC LIABLE TO BE REVERSED IN GST*

Saturday, 4 November 2023

Time for Annual Returns !!Lets revisit exemptions for FY 22-23

Friday, 3 November 2023

उच्च न्यायालय मध्यप्रदेश जीएसटी-SEC 16(4) माननीय मध्य प्रदेश उच्च न्यायालय ने धारा 16(4) की संवैधानिकता को चुनौती देने वाली रिट याचिका स्वीकार कर ली है। केंद्रीय जीएसटी अधिनियम, 2017 के 16(4) और नोटिस जारी किए हैं।

उच्च न्यायालय मध्यप्रदेश

जीएसटी-SEC 16(4)

माननीय मध्य प्रदेश उच्च न्यायालय ने धारा 16(4) की संवैधानिकता को चुनौती देने वाली रिट याचिका स्वीकार कर ली है।

केंद्रीय जीएसटी अधिनियम, 2017 के 16(4) और नोटिस जारी किए हैं।

याचिका पर माननीय मुख्य न्यायाधीश एवं श्री न्यायमूर्ति विशाल मिश्रा की खंडपीठ ने सुनवाई की।

याचिका को स्वीकार करते हुए, माननीय न्यायालय ने आदेश पारित करते हुए प्रसन्नता व्यक्त की कि निर्णय प्राधिकारी द्वारा मामले में आगे की सभी कार्यवाही याचिका के परिणाम के अधीन होगी।

याचिकाकर्ता के मामले पर

नितिन अग्रवाल एडवोकेट के साथ एडवोकेट राजीव नेमा ने पक्ष रखा।

केस का शीर्षक: सिया ट्रेडर्स, (राहतगढ़, जिला सागर) बनाम भारत गणराज्य संघ

डब्ल्यू.पी.

क्रमांक 27344/2023

Wednesday, 11 October 2023

Monday, 11 September 2023

E-Invoicing Time Limit Announcement!!

Thursday, 31 August 2023

Wednesday, 23 August 2023

Wednesday, 16 August 2023

New Rule 11UACA notified by IncomeTaxIndia for Computation of income chargeable to tax under Section 56(2)(xiii) for amount Received under life Insurance policy

Sunday, 13 August 2023

Monday, 24 July 2023

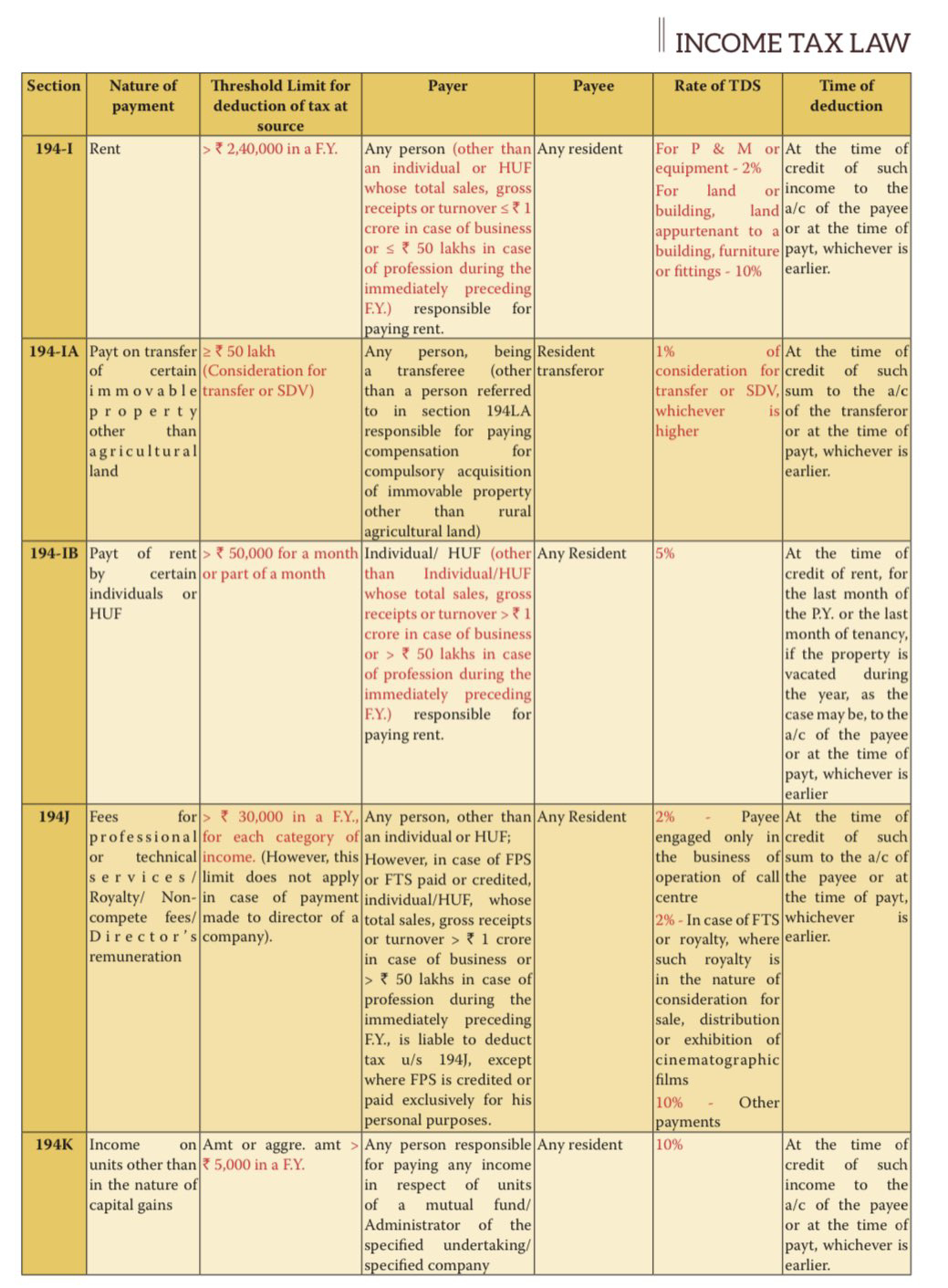

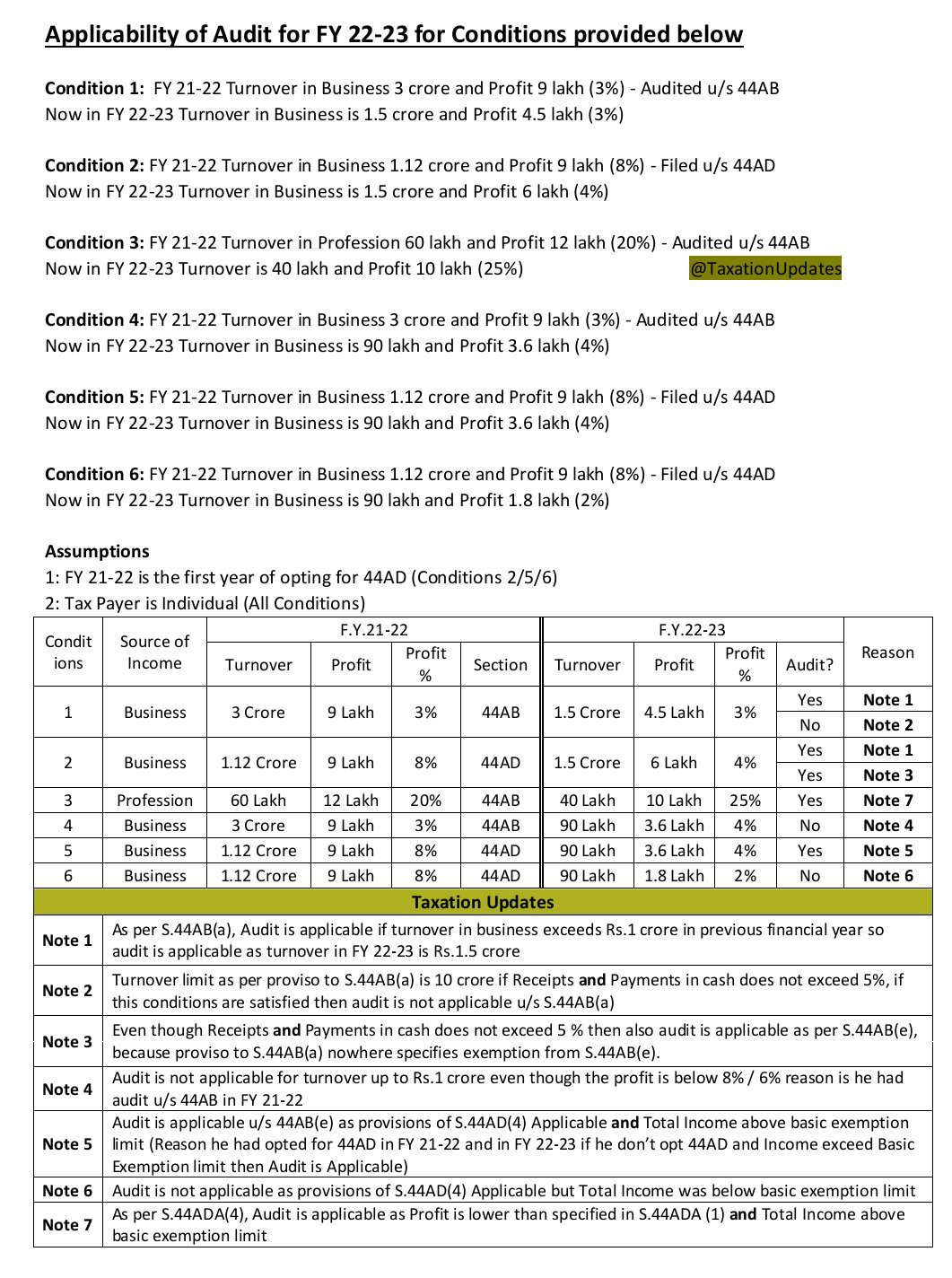

Section 44AA/44AB/44AD/44ADA of Income Tax Act, 1961-2022(To whom it is Applicable and when it is applicable)

Thursday, 13 July 2023

Late Fee is payable if ITR Filed after due date u/s 139(1)Late Fee is₹1,000 if Total Income upto ₹5 Lakh₹5,000 if Total Income above ₹5 LakhLosses if any cannot be c/f if ITR filed after due date u/s 139(1)Income Tax Return & Audit Due Date for A.Y.23-24 (F.Y.22-23)

Wednesday, 12 July 2023

*GST UPDATE:* Assam Government mandates Registered Lease Deed/ Rent Agreement to obtain GST Registration!

Tuesday, 11 July 2023

*Very Imp Decisions taken in 50th GST council meeting today. Brief given below*

Sunday, 2 July 2023

Section 44AD of Income Tax Act

Wednesday, 28 June 2023

अगर प्रोपराइटर की मृत्यु हो जाती है तो इस सम्बन्ध में GST में क्या प्रावधान किए गए। कौन फर्म की देनदारी को अदा करेगा जैसे टैक्स ,पेनाल्टी और INTEREST .

धारा 93 एक अज्ञात अधिनियम का हिस्सा है, जो कुछ विशेष प्रावधानों के बारे में संबंधित है जहां कर, ब्याज या दंड का भुगतान करने की जिम्मेदारी की जाती है। यह निम्नलिखित स्थितियों को व्याख्या करता है:

1. यदि एक व्यक्ति, जो अधिनियम के तहत कर, ब्याज या दंड भुगतान करने के लिए जिम्मेदार है, मर जाता है:

(a) यदि मृतक व्यक्ति द्वारा चलाए गए व्यापार को उनके कानूनी प्रतिनिधि या किसी अन्य व्यक्ति द्वारा मृत्यु के बाद भी जारी रखा जाता है, तो ऐसे कानूनी प्रतिनिधि या अन्य व्यक्ति को अधिनियम के तहत मृतक व्यक्ति द्वारा बकाया कर, ब्याज या दंड का भुगतान करना होगा।

(b) यदि मृतक व्यक्ति द्वारा चलाए गए व्यापार को मृत्यु से पहले या मृत्यु के बाद बंद कर दिया गया है, तो कानूनी प्रतिनिधि को मृतक की संपत्ति से भुगतान करना होगा, जहां तक संपत्ति का भार आवश्यकता को पूरा करने में सक्षम है,

अधिनियम के तहत उनके द्वारा बकाया कर, ब्याज या दंड का। यह इस तक लागू होता है कि ऐसा कर, ब्याज या दंड मृत्यु से पहले निर्धारित किया गया हो, लेकिन अवैतनिक रहा हो या मृत्यु के बाद निर्धारित किया जाता हो।

2. यदि अधिनियम के तहत कर, ब्याज या दंड भुगतान करने के लिए जिम्मेदार होने वाला व्यक्ति हिन्दू संयुक्त परिवार या व्यक्ति संघ हो, और हिन्दू संयुक्त परिवार या व्यक्ति संघ की संपत्ति को सदस्यों या समूहों के बीच विभाजित किया गया हो:

प्रत्येक सदस्य या समूह संयुक्त और अविभाज्य रूप से जिम्मेदार होंगे कर, ब्याज या दंड का भुगतान करने के लिए अधिनियम के तहत कर्तव्यशील व्यक्ति से उनके सामर्थ्य के अनुरूप। यह इस तक लागू होता है कि कर, दंड या ब्याज पहले विभाजन से पहले निर्धारित किया गया हो, लेकिन अवैतनिक रहा हो या विभाजन के बाद निर्धारित किया जाता हो।

3. यदि अधिनियम के तहत कर, ब्याज या दंड भुगतान

करने के लिए जिम्मेदार होने वाला व्यक्ति एक कारोबार है, और कारोबार बिखर जाता है:

व्यापारियों के रूप में सम्मिलित हुए प्रत्येक व्यक्ति जो भी भागीदार था, संयुक्त और अविभाज्य रूप से जिम्मेदार होंगे कर, ब्याज या दंड का भुगतान करने के लिए अधिनियम के तहत व्यापार से पूर्व से लेकर समाप्ति तक। यह इस तक लागू होता है कि कर, ब्याज या दंड पहले समाप्ति से पहले निर्धारित किया गया हो, लेकिन अवैतनिक रहा हो या समाप्ति के बाद निर्धारित किया जाता हो।

4. यदि अधिनियम के तहत कर, ब्याज या दंड भुगतान करने के लिए जिम्मेदार होने वाला व्यक्ति:

(a) कारण से पुत्रवत व्यापार चलाने वाले अभिभावक हो, या

(b) लाभार्थी के लिए एक आश्रय के तहत व्यापार चलाने वाला एक धर्मोपदेशक हो,

तो, यदि पुत्रवत या आश्रय समाप्त होता है, तो व्यापारी व्यक्ति के बाकी कर, ब्याज या दंड का भुगतान करने के लिए उत्पन्न होगा, समय के साथी पुत्रवत या

आश्रय के समाप्ति तक, चाहे ऐसा कर, ब्याज या दंड पुत्रवत या आश्रय के समाप्ति से पहले निर्धारित किया गया हो, लेकिन अवैतनिक रहा हो या पुत्रवत या आश्रय के बाद निर्धारित किया जाता हो।

Tuesday, 27 June 2023

APPEAL UNDER GST

FAQ on E-invoice in Hindi

FAQ on E-invoice in Hind

Tuesday, 13 June 2023

अलाहाबाद उच्च न्यायालय ने जीएसटी सूचना को वकीलों के पक्ष में ध्यान में लिया है।

लखनऊ के अलाहाबाद उच्च न्यायालय की बेंच ने सीजीएसटी और उत्पाद शुल्क विभाग के साथ गंभीर चिंता व्यक्त की है क्योंकि वकीलों को सेवा कर के भुगतान के लिए Notices जारी की जा रही हैं, हालांकि यह तथ्य है कि वकीलों की सेवाएं इन करों से छूटी हुई हैं। बेंच ने सीजीएसटी आयुक्त को निर्देश दिया है कि वह लखनऊ के जीएसटी आयुक्तालय को स्पष्ट निर्देश जारी करें, जिसमें कहा गया हो कि वकीलों को सेवा कर के भुगतान से संबंधित कोई सूचना न भेजी जाए।

The Lucknow bench of the Allahabad high court has expressed serious concern with the CGST and excise department for issuing notices to advocates for paying service tax as well as levy tax, despite the fact that services of advocates are exempted from these taxes. The bench has directed the commissioner, GST, to issue a clear direction to the GST commissionerate in Lucknow that no notices regarding payment of service tax/GST is issued to the lawyers.

A vacation bench of Justices Alok Mathur and Jyotsna Sharma passed the order on the petition. The petitioner had challenged the order of May 25, 2023 passed by the deputy commissioner, CGST & Central Excise Div. Lucknow - 1, Lucknow, assessing him with regard to service tax and levying tax and interest to the tune of Rs 3.32 lakh.

Saturday, 10 June 2023

Saturday, 27 May 2023

Exemption Notification- The notification you mentioned, Notification No. 12/2017-Central Tax (Rate)

The notification you mentioned, Notification No. 12/2017-Central Tax (Rate), was issued by the Central Government of India on June 28, 2017, under the powers conferred by sub-section (1) of section 11 of the Central Goods and Services Tax Act, 2017.

The purpose of this notification is to provide an exemption from a portion of the central tax on certain intra-State supplies of services. It states that the services mentioned in column (3) of the Table in the notification will be exempted from the central tax, to the extent that the tax payable exceeds the rate specified in column (4) of the Table.

In simpler terms, if the rate of central tax applicable to a particular service is higher than the rate mentioned in the notification, the excess tax above the specified rate will be exempted.

The exemption is subject to certain conditions specified in column (5) of the Table. These conditions outline the requirements that need to be fulfilled in order to avail the exemption. The details of these conditions can be found in the corresponding entry in column (5) of the notification.

Please note that the specific details, services, rates, and conditions mentioned in the notification are not provided in your query. If you require further information or specific details from the notification, please provide the relevant entries from the Table for a more detailed explanation.

अगर बिना GTA के माल का परिवहन हुआ है तो आरसीएम मे टैक्स नहीं जमा होगा ।

अर्थात अगर हमने या हमारे supplier ने किसी ट्रक /वाहन को माल ढोने के लिए उसे हायर किया है तो RCM मे टैक्स नहीं जमा होगा ।

संगठित रूप से दिये गए नोटिफिकेशन No. 12/2017-केंद्रीय कर (दर) नई दिल्ली, 28 जून 2017, निर्धारित धारा 11(1) के तहत, केंद्रीय सामान और सेवा कर अधिनियम, 2017 (12 केंद्रीय कर (दर) नई दिल्ली, 28 जून 2017 जून 2017) की अधिकारी प्राधिकार से, काउंसिल की सिफारिशों पर, यहाँ तक कि जनहित में जरूरी माना जाता है कि इसे करना आवश्यक है, यहाँ तक कि केंद्रीय कर अधिनियम की धारा 9(1) के तहत कर लागू होने वाले ऐसे सेवा की राज्यांतरीय आपूर्ति को अपने शुल्क से छूट देता है जिनका विवरण निम्नलिखित सारणी के कॉलम (3) में विशेषित किया गया है, यदि कॉलम (4) में संबंधित प्रविष्टि में विशेषित कर की दर की गणना की गई कर की मात्रा से अधिक होता है, तब तक कर की छूट दी जाएगी, जैसा कि कॉलम (4) में उल्लेखित दर की गणना की जाती है। इसके अलावा, यदि अन्यथा निर्दिष्ट नहीं होता है, यह छूट उपलब्ध होगी।

*SOP for Scrutiny of Returns for 2019-20 [Instruction 2/2023 dated 26-05-2023

Tuesday, 23 May 2023

GSTN set to go live on Account Aggregator Ecosystem ahead of 1st July 2023

CBDT released Tax Calculator for Financial Year 2023-24

Saturday, 20 May 2023

Rule 88B . Manner of Calculating interest on delayed payment of tax

1 [ Rule 88B. Manner of calculating interest on delayed payment of tax.-

(1) In case, where the supplies made during a tax period are declared by the registered person in the return for the said period and the said return is furnished after the due date in accordance with provisions of section 39, except where such return is furnished after commencement of any proceedings under section 73 or section 74 in respect of the said period, the interest on tax payable in respect of such supplies shall be calculated on the portion of tax which is paid by debiting the electronic cash ledger, for the period of delay in filing the said return beyond the due date, at such rate as may be notified under sub-section (1) of section 50.

(2) In all other cases, where interest is payable in accordance with sub section (1) of section 50, the interest shall be calculated on the amount of tax which remains unpaid, for the period starting from the date on which such tax was due to be paid till the date such tax is paid, at such rate as may be notified under sub-section (1) of section 50.

(3) In case, where interest is payable on the amount of input tax credit wrongly availed and utilised in accordance with sub-section (3) of section 50, the interest shall be calculated on the amount of input tax credit wrongly availed and utilised, for the period starting from the date of utilisation of such wrongly availed input tax credit till the date of reversal of such credit or payment of tax in respect of such amount, at such rate as may be notified under said sub-section (3) of section 50.

Explanation.-For the purposes of this sub-rule, -

(1) input tax credit wrongly availed shall be construed to have been utilised, when the balance in the electronic credit ledger falls below the amount of input tax credit wrongly availed, and the extent of such utilisation of input tax credit shall be the amount by which the balance in the electronic credit ledger falls below the amount of input tax credit wrongly availed.

(2) the date of utilisation of such input tax credit shall be taken to be, -

(a) the date, on which the return is due to be furnished under section 39 or the actual date of filing of the said return, whichever is earlier, if the balance in the electronic credit ledger falls below the amount of input tax credit wrongly availed, on account of payment of tax through the said return; or

(b) the date of debit in the electronic credit ledger when the balance in the electronic credit ledger falls below the amount of input tax credit wrongly availed, in all other cases.]

1. Inserted vide Notification No. 14/2022-CT dated. 05.07.2022 w.e.f. 01.07.2017.