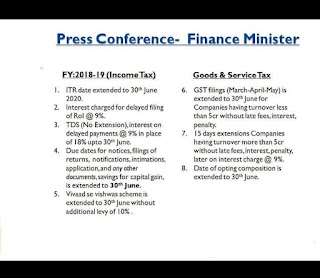

Key Highlights of Press Conference of Finance Minister on COVID- 2019 are as follows:-

Income Tax

- Extend last date for income tax returns for (FY 18-19) from 31st March, 2020 to 30th June, 2020.

- Aadhaar-PAN linking date to be extended from 31st March, 2020 to 30th June, 2020.

- Vivad se Vishwas scheme – no additional 10% amount, if payment made by June 30, 2020.

- Due dates for issue of notice, intimation, notification, approval order, sanction order, filing of appeal, furnishing of return, statements, applications, reports, any other documents and time limit for completion of proceedings by the authority and any compliance by the taxpayer including investment in saving instruments or investments for roll over benefit of capital gains under Income Tax Act, Wealth Tax Act, Prohibition of Benami Property Transaction Act, Black Money Act, STT law, CTT Law, Equalization Levy law, Vivad Se Vishwas law where the time limit is expiring between 20th March 2020 to 29th June 2020 shall be extended to 30th June 2020.

- For delayed payments of advanced tax, self-assessment tax, regular tax, TDS, TCS, equalization levy, STT, CTT made between 20th March 2020 and 30th June 2020, reduced interest rate at 9% instead of 12 %/18 % per annum ( i.e. 0.75% per month instead of 1/1.5 percent per month) will be charged for this period. No late fee/penalty shall be charged for delay relating to this period.

- Necessary legal circulars and legislative amendments for giving effect to the aforesaid relief shall be issued in due course.

GST/Indirect Tax

- Last date for filing GSTR-3B in March, April and May 2020 will be extended till the last week of 30th June, 2020 for those having aggregate annual turnover less than Rs. 5 Crore. No interest, late fee, and penalty to be charged.

- For any delayed payment made between 20th March 2020 and 30th June 2020 reduced rate of interest @9 % per annum ( current interest rate is 18 % per annum) will be charged. No late fee and penalty to be charged, if complied before till 30th June 2020.

- Date for opting for composition scheme is extended till the last week of June, 2020. Further, the last date for making payments for the quarter ending 31st March, 2020 and filing of return for 2019-20 by the composition dealers will be extended till the last week of June, 2020.

- Date for filing GST annual returns of FY 18-19, which is due on 31st March, 2020 is extended till the last week of June 2020.

- Due date for issue of notice, notification, approval order, sanction order, filing of appeal, furnishing of return, statements, applications, reports, any other documents, time limit for any compliance under the GST laws where the time limit is expiring between 20th March 2020 to 29th June 2020 shall be extended to 30th June 2020.

- Necessary legal circulars and legislative amendments to give effect to the aforesaid GST relief shall follow with the approval of GST Council.

- Payment date under Sabka Vishwas Scheme shall be extended to 30th June, 2020. No interest for this period shall be charged if paid by 30th June, 2020.

Customs

- 24X7 Custom clearance till end of 30th June, 2020

- Due date for issue of notice, notification, approval order, sanction order, filing of appeal, furnishing applications, reports, any other documents etc., time limit for any compliance under the Customs Act and other allied Laws where the time limit is expiring between 20th March 2020 to 29th June 2020 shall be extended to 30th June 2020.

No comments:

Post a Comment