(Advocate) ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~GST & INCOME TAX ============================================================================ Sharing of Information related to GST and INCOME TAX.

Search Box

Wednesday, 31 January 2024

Tuesday, 30 January 2024

GST Appeal Manual - How to File Appeal online issued by GSTN

जीएसटी अपील मैनुअल - जीएसटीएन द्वारा जारी ऑनलाइन अपील कैसे दायर करें

GST Appeal Manual - How to File Appeal online issued by GSTN

Pls save this file for Easy Future Reference For Filling Appeal process

Monday, 15 January 2024

Tuesday, 9 January 2024

Sunday, 7 January 2024

Friday, 5 January 2024

e-Waybill generation will not be allowed without e-Invoice details from 1st March 2024

e-Waybill generation will not be allowed without e-Invoice details from 1st March 2024

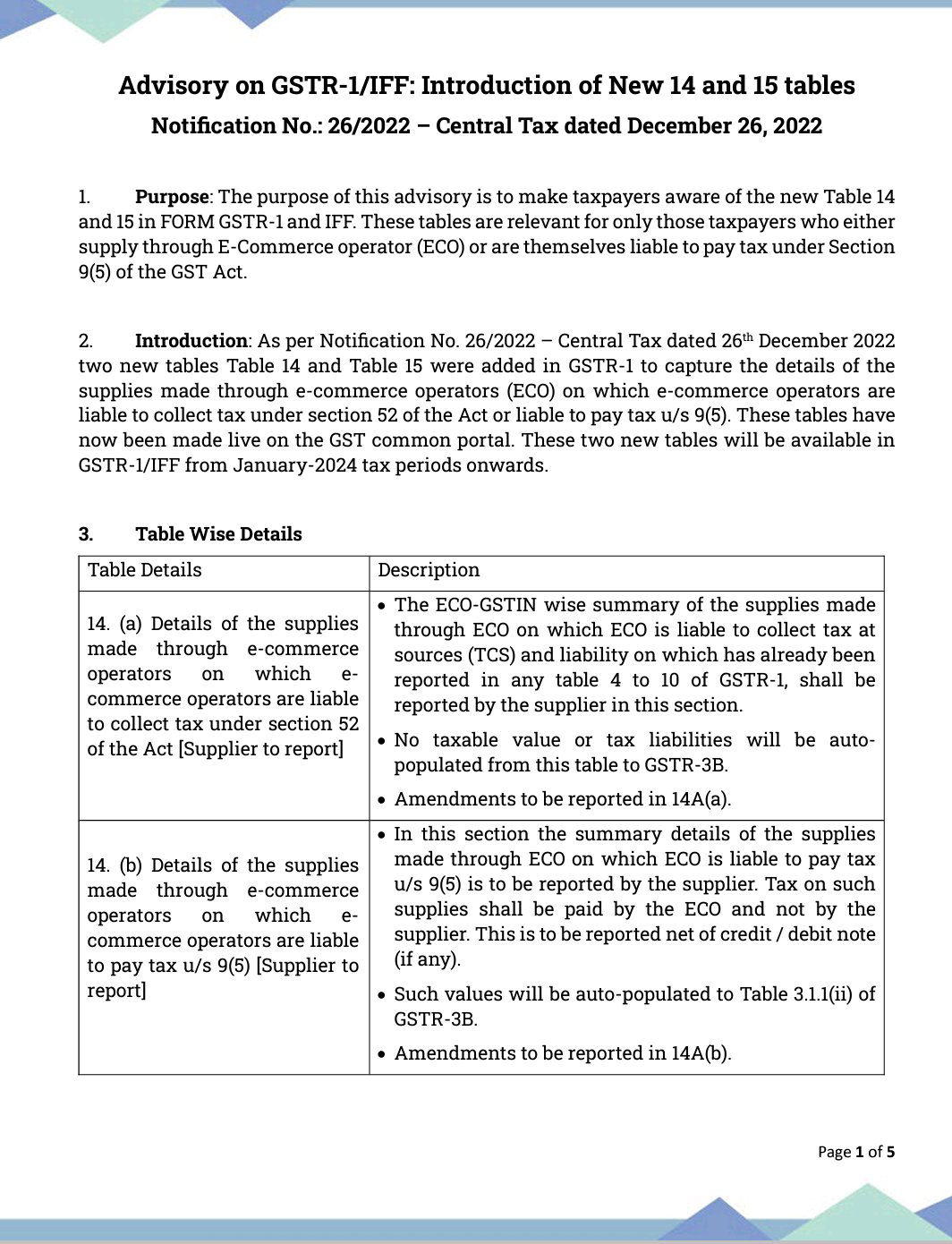

Blocking the generation of E-Way Bill without e-Invoice/IRN

details for B2B and B2E transactions for e-invoice enabled tax payers (Dated: 05-01-2024)

Thursday, 4 January 2024

GTA to file online declaration for FY 24-25 :--Opting Forward Charge in Annexure V-Reverting to RCM in Annexure VIFacility available from 1st Jan to 31st March 24

GTA to file online declaration for FY 24-25 :-

-Opting Forward Charge in Annexure V

-Reverting to RCM in Annexure VI

Facility available from 1st Jan to 31st March 24

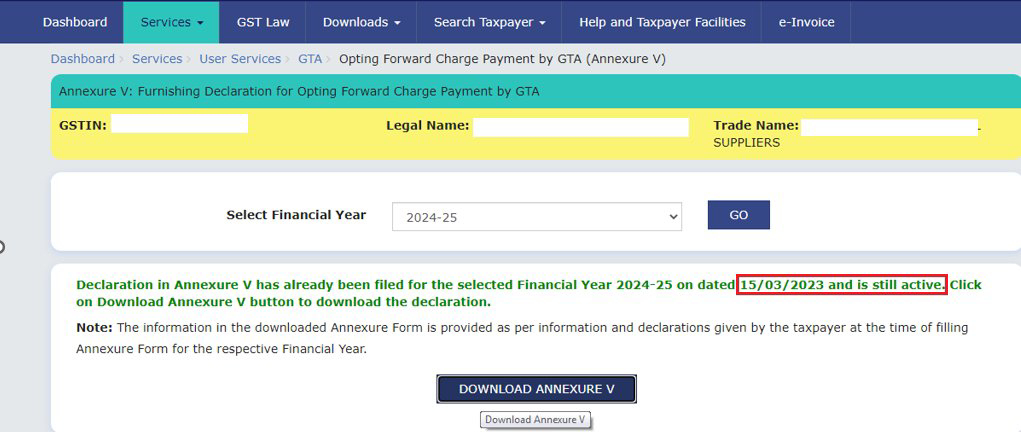

Also imp to note that GTA who has already opted Forward Charge in a FY shall be deemed to have exercised for next and future financial year unless GTA files Annexure-VI to revert to RCM

So if Annx. V for Forward Charge has been filed for FY 2023-24, then no need to file Ann. V separately for FY 24-25 if GTA wants to continue with FC👇

Also portal doesn't allow to file Annex V in such case and shows a message that Filed Annx. V is still active.

Professionals/Transporters are advised not to wait till the last date :)

Tuesday, 2 January 2024

GST Rate on Scrap Materials with HSN Code

GST Rate on Scrap Materials with HSN Code

HSN Code Description GST Rate

3915 Plastic waste, parings or scrap 18% | read notification

4004 Rubber waste, parings or scrap 5%

4004 Powders and Granules obtained from waste, parings and scrap of rubber 18%

4017 00 20 Hard Rubber waste or scrap 5%

4401 Wood Scrap 5%

4415 Packing cases, Box, Crates, Drums 5%

4707 Paper waste or scrap 5%

7001 Cullet or other waste or scrap of Glass 5%

2524 Asbestos waste 5%

7112 Waste and scrap of precious metal 3%

3006 Pharmaceutical Waste (except Contraceptives) 12%

3825 Municipal waste, sewage sludge, clinical waste 0%

2621 Slag Ash Waste 18%

7204 Vehicle Scrap 18%

7204 MS Scrap of all types 18%

7204 Scrap US Rail 18%

7404 Copper Waste Scrap 18%

7408 Bronze Waste Scrap 18%

7503 Nickel Waste Scrap 18%

7602 Aluminium Waste Scrap 18%

7902 Zinc Waste Scrap 18%

8002 Tin Waste & Scrap 18%

8113 Cermets and articles thereof waste and scrap 18%

85 E-Waste 5%

8548 Waste and scrap of primary Cells primary batteries and electric accumulators 18%

Monday, 1 January 2024

Advisory on the functionalities available on the portal for the GTA taxpayers:

01/01/2024

Dear Taxpayers,

The following Functionalities are made available on the portal for the GTA Taxpayers.

Filing of Online Declaration in Annexure V and Annexure VI for the existing GTA Taxpayers: As per the Notification No. 06/2023-Central Tax (Rate), dated 26.07.2023, the option by GTA to pay GST on Forward Charge mechanism or the Reverse Charge mechanism respectively on the services supplied by them during a Financial Year shall be exercised by making a declaration in Annexure V or Annexure VI from the 1st January of the current Financial Year till 31stMarch of the current Financial Year, for the next Financial Year.

To comply with the above notification, online filing in Annexure V Form and Annexure VI Form is available on the portal for the existing GTA taxpayers for filing declaration in Annexure V Form or Annexure VI Form for the succeeding FY 2024-25 from 01.01.2024 to 31.03.2024.

To Access Annexure V Form: Post login on the FO portal-Navigate to Services>>User Services>>GTA>>Opting Forward Charge Payment by GTA (Annexure V).

To Access Annexure VI Form: Post login on the FO portal-Navigate to Services>>User Services>>GTA>>Opting to Revert under Reverse Charge Payment by GTA (Annexure VI)

Filing of Online Declaration in Annexure V for the Newly registered GTA Taxpayers: As per the Notification No. 5/2023-Central Tax (Rate), dated 09.05.2023, the option to pay GST on Forward Charge mechanism on the services supplied the Newly registered taxpayers can now be able to file their declaration within the specified due date for the current Financial Year i.e. 2023-2024 and onwards. The due date (before the expiry of forty-five days from the date of applying for GST registration or one month from the date of obtaining registration whichever is later) is now being configured by the system and the same would be displayed to the newly registered taxpayers on their dashboard. The newly registered GTA taxpayers can now file their online declaration on the portal for the current FY within the specified due date.

To Access: Post login on the FO portal-Click YES on the pop up message on post login (or) Navigate to Services>>User Services>>GTA>>Opting Forward Charge Payment by GTA (Annexure V).

Uploading manually filed Annexure V Form for the FY 2023-24 on the portal: The Existing/ Newly registered GTA taxpayers who have already submitted Declaration in Annexure V Form for the FY 2023-24 manually with the jurisdictional authority are requested to upload their duly acknowledged legible copy of the Annexure V Form on the portal, mentioning correct particulars as mentioned in the physical Annexure V submitted, with correct date of acknowledgement from jurisdictional office, where such physical Annexure V was filed for the record purposes. Further it is informed that if the Annexure V was filed manually within the specified due date for the FY 2023-24, he need not to file it again on the portal for the FY 2024-25 or any succeeding FY. By utilizing the manual upload facility, you can upload the legible copy of duly acknowledged manually filed Annexure V for 2023-24, with correct particulars.

To Access: Post login on the FO portal-Navigate to Services>>User Services>>GTA>> Upload Manually Filed Annexure V.

As per the above notification, the option exercised by GTA to itself pay GST on the services supplied by it during a Financial Year shall be deemed to have been exercised for the next and future financial years unless the GTA files a declaration in Annexure VI to revert under reverse charge mechanism.

However, the GTAs who filed declaration for the FY 2024-25 on the portal for the period from 27.07.2023 till 22-08-2023 has been considered as filed and valid. Those taxpayers are requested that they need not file declaration in Annexure V Form for the subsequent FYs if they wish to continue their option for pay GST on Forward charge mechanism.

1st Update of 2024

1st Update of 2024

E-filing of Updated ITR has been enabled on Income Tax Portal for AY 2023-24 (FY 2022-23)

Subscribe to:

Comments (Atom)