October – the last quarter of 2020 is here already!

While this year has seen a lot of roadblocks with a pandemic hitting the world followed by a lockdown and economic crises, it sure has kept our minds occupied and has made us solution-oriented.

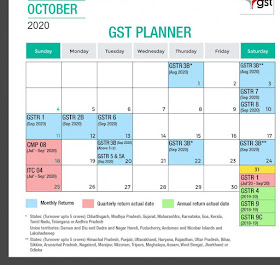

On the GST front, the e-invoicing implementation has finally seen the light of day and is set to roll from 1st October 2020 for companies with turnover Rs. 500 crores or more.

The upcoming GST Council Meeting is said to be scheduled on October 5, 2020. The trending matter of compensation cess to the states will be discussed. The council is expected to approve a two-year extension of compensation cess levy on goods and services to allow the Centre to pay the entire shortfall in GST tax collection by states.

The GST collection for June stood at Rs 90,917 crore and the collection for July was at Rs 87,422 crore. In the month of August, the GST collection further dropped and stood at Rs 86,449 crore. From this aggregate amount, Rs 15,906 crore is CGST, Rs 21,064 crore is SGST, IGST of Rs 42,264 crore including Rs 19,179 crore collected on import of goods and a cess collection of Rs 7, 215 crores including Rs 673 crore collected on import of goods.

Recently, the government offered relief in late fees to Taxpayers filing Form GSTR 4 or GSTR 10 and change in the navigation of Comparison of liability declared and ITC claimed the report. There have been several new updates released in the past month.

Prominent Indian festivals like Navratri and Dusshera fall in October. Just like Ganesh Chaturthi, pandaals and group gatherings will be prohibited citing the rising cases of COVID-19 throughout the country. People will have to celebrate keeping in mind the solemnity of the present scenario.

No comments:

Post a Comment

Plz Type Your View/Comment