Rectification Applications under GST Laws: Analyzing Mistakes and Judgments

We all are in the process of filing Rectification Applications U/s 161 of GST Laws for "Mistake Apparent from Records."

What are the mistakes that are apparent from the records?

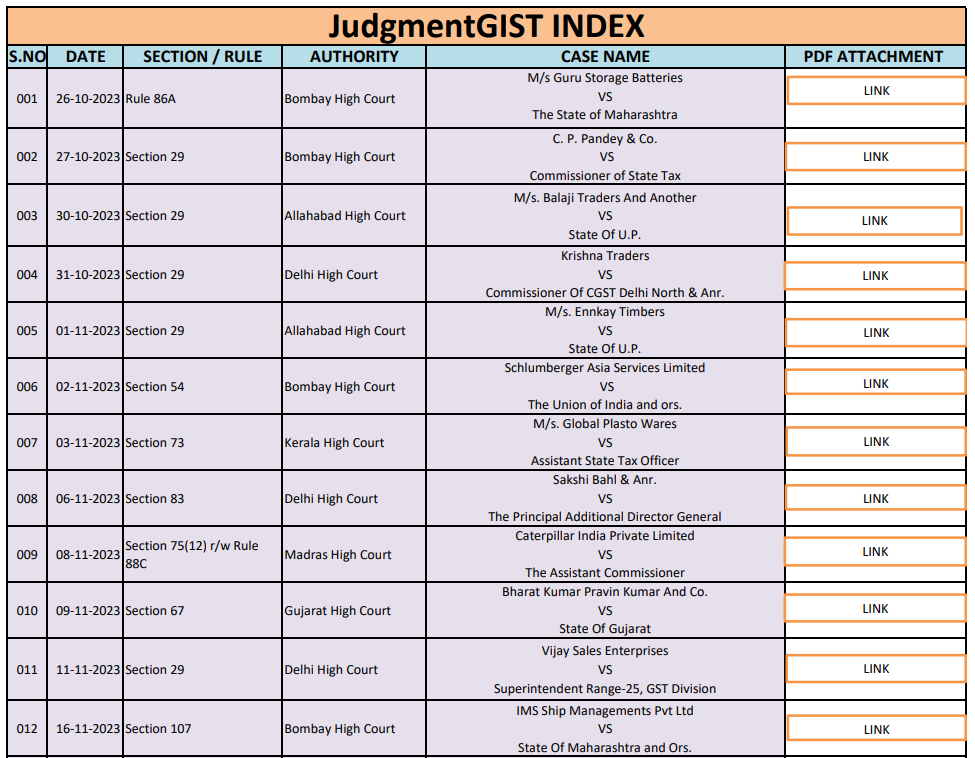

Let's analyze various judgments

Right of this research with: Abhishek Raja Ram

1. Delhi High Court

1.1 Food Specialities Limited (1984)

If two opinions about a question are open, then it is also not a mistake. It is only if the matter is so obvious that there can be only one answer and not much reasoning is required that one can say : It is an apparent mistake.

2. Calcutta High Court

2.1 M/s Russel Properties (P.) Ltd. (1985)

ARR: Capital gains computed on basis of one view: Failure to adopt a different view - Not a mistake apparent from the record that can be rectified.

3. Kerala High Court

3.1 M/s Ram Bahadur Thakur Ltd., Cochin

Entering into reasonableness of the expenditure claimed by the assessee in connection with the transfer - Cannot be said to be a mistake apparent from record.

3.2 Equity Intelligence India Pvt. Ltd., Cochin (2021)

Assessee claiming that Assessing Officer refused to consider Circular while issuing assessment order is not a mistake apparent on face of record to be rectified in proceedings u/S. 154. ARR

4. Andhra Pradesh High Court

4.1 P. R. N. S. and Co., Anantapur (1976)

Mistake apparent on the record must be an obvious and patent mistake, and not something that can be established by a long drawn process of reasoning on points on which there may be conceivably two opinions.

A decision on a debatable point of law is not a mistake apparent from the record.

5. Rajasthan High Court

5.1 B.L. Murarka (2001)

Only apparent mistake can be rectified - Decision on debatable point of law - Is not a mistake apparent from record.

6. Supreme Court

6.1 Saurashtra Kutch Stock Exchange Ltd (2008)

Non-consideration of the decision of the jurisdictional High Court/Supreme Court by the Tribunal - (ARR) Can be said to be mistake apparent from record.

7. Orissa High Court

7.1 Commissioner of Income-tax, Orissa v. Income-tax Appellate Tribunal, Cuttack Bench (1991)

Mistakes highlighted by assessee in order of Tribunal relating to certain erroneous conclusions -

Conclusions even if inappropriate do not constitute 'mistakes apparent from record' - Tribunal recalling its order - Not justified.

I hope you will find this useful.

Warm Regards

Abhishek Raja Ram